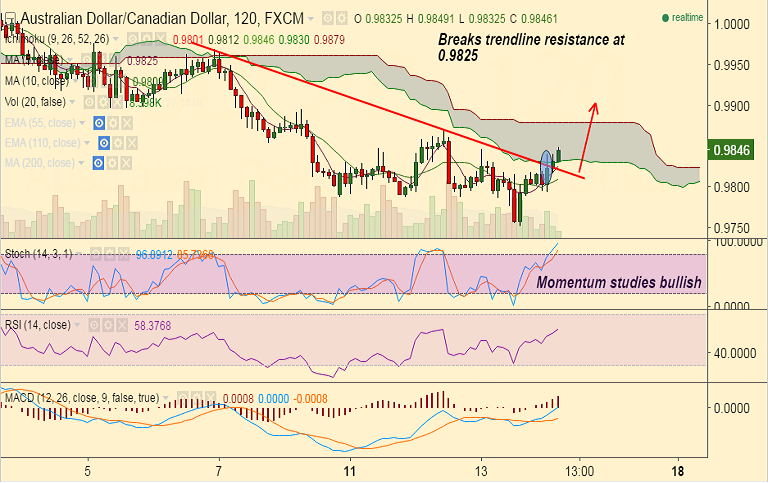

- AUD/CAD has broken strong trendline resistance at 0.9825, momentum is bullish.

- Better-than-expected Australian employment figures support upside in the Aussie. Data should lower the odds of further cuts by the Reserve Bank of Australia.

- The Australian Bureau of Statistics reported an Australian employment change s.a. of +26.1K in March, above forecasts of +17k, with the unemployment rate s.a. at 5.7% vs 5.9% exp.

- 2H cloud base at 0.9830 is strong support for the pair, while upside finds immediate resistance at 0.9871 (session highs Apr 12th).

Recommendation: Good to buy dips around 0.9835/40, SL: 0.98, TP: 0.9870/0.9895