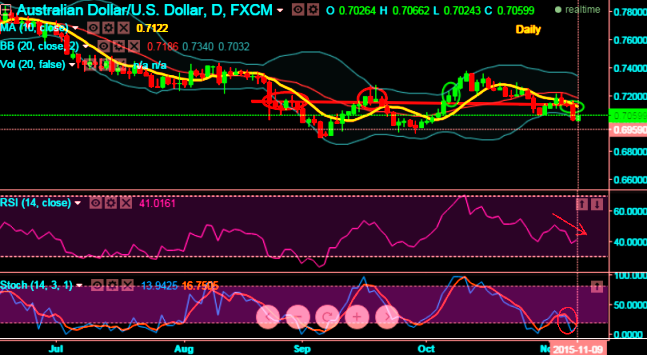

A resembling bearish Marubozu pattern occurred at 0.7035 levels to confirm the breach of supports at 0.7140 levels.

Previously, a gravestone doji was occurred at the same levels on daily charts and the trend on this chart has still been fragile as the leading oscillators are converging downwards with massive price dips.

RSI curve is converging downwards that fortifies bearish sentiments to prevail. Currently, RSI is trending at 40.0290 while articulating.

While %D line crossover is still on even after reaching oversold territory on slow stochastic. No trace of %K crossing over which means bears are still under control over the selling streaks.

Overall, the major trend has been downtrend dominated by the bears with clear volume confirmation, price being fallen below 10DMA and above stated support levels has now exposed towards 0.7007 levels and even retesting 6 and half years low cannot be disregarded up to 0.6965.

Losing streak has been stronger from mid to hit almost 6 and half year's lows. On weekly charts, from last April the pair has been tumbling non-stop to evidence the huge loses.

The implied volatility for near month contracts of AUDUSD pair has been highest among G20 currency pool, likely to perceive at 11.75%.

We recommend on pure speculation basis buying one touch binary puts in order to extract leverage on extended profitability. By employing At-The-Money binary delta puts one can multiply returns by twice, thrice or even pour returns exponentially. But do remember these are exclusively for speculative basis.

The prime merits of such one touch option are high yields during high volatility plays. Wider spreads indicates lack of liquidity. The spreads for one touch AUD/USD options are constant time and barrier levels. Usually, such binary options for every change in 1 pip the relative change in option price 0.01% or even exponential at high implied volatility times.

FxWirePro: AUD/USD relentless downswings on breach of 0.7140, binary puts for target 60 pips

Monday, November 9, 2015 10:19 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook

FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook  EUR/JPY Coils Tightly Above 183.20 – Bulls Ready to Push Toward 186

EUR/JPY Coils Tightly Above 183.20 – Bulls Ready to Push Toward 186  FxWirePro:EUR/AUD upside limited, scope for a dve through a key fibo

FxWirePro:EUR/AUD upside limited, scope for a dve through a key fibo  FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside

FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside  FxWirePro- Major European Indices

FxWirePro- Major European Indices  FxWirePro: USD/JPY dips as yen gains after Tokyo CPI data

FxWirePro: USD/JPY dips as yen gains after Tokyo CPI data  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  AUDJPY Reclaims 111 Handle: Bulls Eye 112 Target After Dip

AUDJPY Reclaims 111 Handle: Bulls Eye 112 Target After Dip  FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish

FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish  FxWirePro: NZD/USD edges up, remains on front foot

FxWirePro: NZD/USD edges up, remains on front foot  NZDJPY Retraces on Tokyo CPI: Bulls Eye 95.00 Target as Support Holds

NZDJPY Retraces on Tokyo CPI: Bulls Eye 95.00 Target as Support Holds  Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone

Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone  FxWirePro: EUR/NZD recovers slightly but bears are not done yet

FxWirePro: EUR/NZD recovers slightly but bears are not done yet  FxWirePro:EUR/AUD neutral in the near-term, scope for downward resumption

FxWirePro:EUR/AUD neutral in the near-term, scope for downward resumption  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: GBP/AUD extends drop, vulnerable to more downside

FxWirePro: GBP/AUD extends drop, vulnerable to more downside  FxWirePro: GBP/USD slips ahead of Manchester local election

FxWirePro: GBP/USD slips ahead of Manchester local election