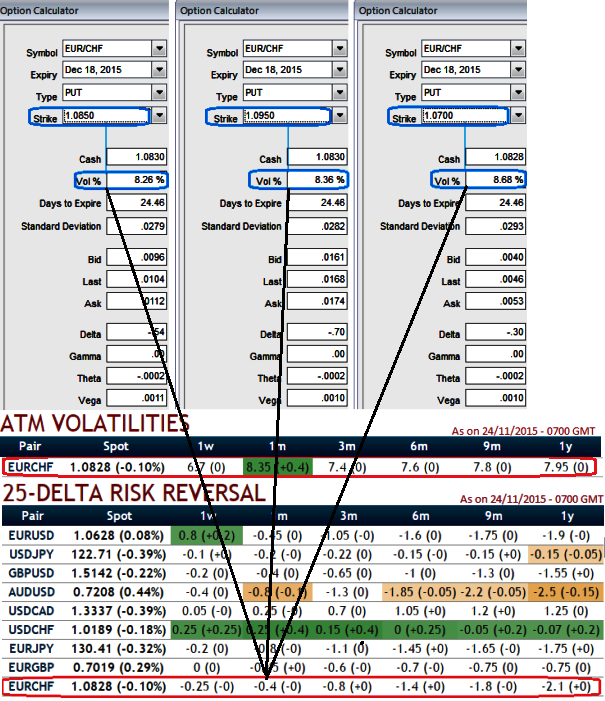

In a true smile, options with an at-the-money strike are priced with a lower volatility than out-of-the-money and in-the-money volatility strikes. Such market occurrences are observable in the EURCHF FX OTC market.

For instance, suppose we've constructed an at the money put option of EURCHF with near month expiries and with given maturities implied volatility has been around 8.26%, and that its delta amounts close to 54%.

We ponder now with an another put option with the same maturity with an implied volatility creeping up at 8.36% but its strike is 1% in the money (strike at 1.0830) and while its delta is just shy of 70%.

Furthermore, let's contemplate a 3rd option with a strike out of the money strike (1%) and a delta of 30% is also priced with a volatility of 8.68%.

Now just have a glance on delta risk reversal table that signifying hedging activities for downside risks are piling up. As a result ATM puts look more costlier.

So, comparing vols of all three put instruments with risk reversal table, we can empathize more downside sentiments seen in the FX option markets. Hence, risk reversals evidencing downside hedging is justifiable because we've highest probability (8.68%) to reach our OTM target.

On a 1-3m horizon, our target for this pair is still lower though we have adjusted our Q4 forecast (at 1.10) but certainly not with steep moves. Fundamentally, the latest quarterly SNB meeting also did nothing to change the currency outlook.

Although EUR/CHF reached a new post-floor high in the beginning September (at 1.1049), the pace of appreciation is painfully slow, Infact the fluctuation has been softened.

We have positioned for lower EUR/CHF in options with a risk reversal but the medium tenor (1m-3m expiring Dec 2015 or so).

FxWirePro: Back testing of EUR/CHF risk reversals - volatility smiles suggest OTM instruments

Tuesday, November 24, 2015 1:23 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish

FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish  NZDJPY Retraces on Tokyo CPI: Bulls Eye 95.00 Target as Support Holds

NZDJPY Retraces on Tokyo CPI: Bulls Eye 95.00 Target as Support Holds  FxWirePro: NZD/USD edges up, remains on front foot

FxWirePro: NZD/USD edges up, remains on front foot  AUDJPY Reclaims 111 Handle: Bulls Eye 112 Target After Dip

AUDJPY Reclaims 111 Handle: Bulls Eye 112 Target After Dip  FxWirePro: USD/CAD changes short term trend from neutral to bearish

FxWirePro: USD/CAD changes short term trend from neutral to bearish  Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize

Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize  FxWirePro:EUR/AUD neutral in the near-term, scope for downward resumption

FxWirePro:EUR/AUD neutral in the near-term, scope for downward resumption  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro: GBP/USD slides as UK political uncertainty weighs on pound

FxWirePro: GBP/USD slides as UK political uncertainty weighs on pound  FxWirePro: GBP/AUD key support held, downside risk remains

FxWirePro: GBP/AUD key support held, downside risk remains  FxWirePro: EUR/NZD recovers slightly but bears are not done yet

FxWirePro: EUR/NZD recovers slightly but bears are not done yet  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone

Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone  FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside

FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook

FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook