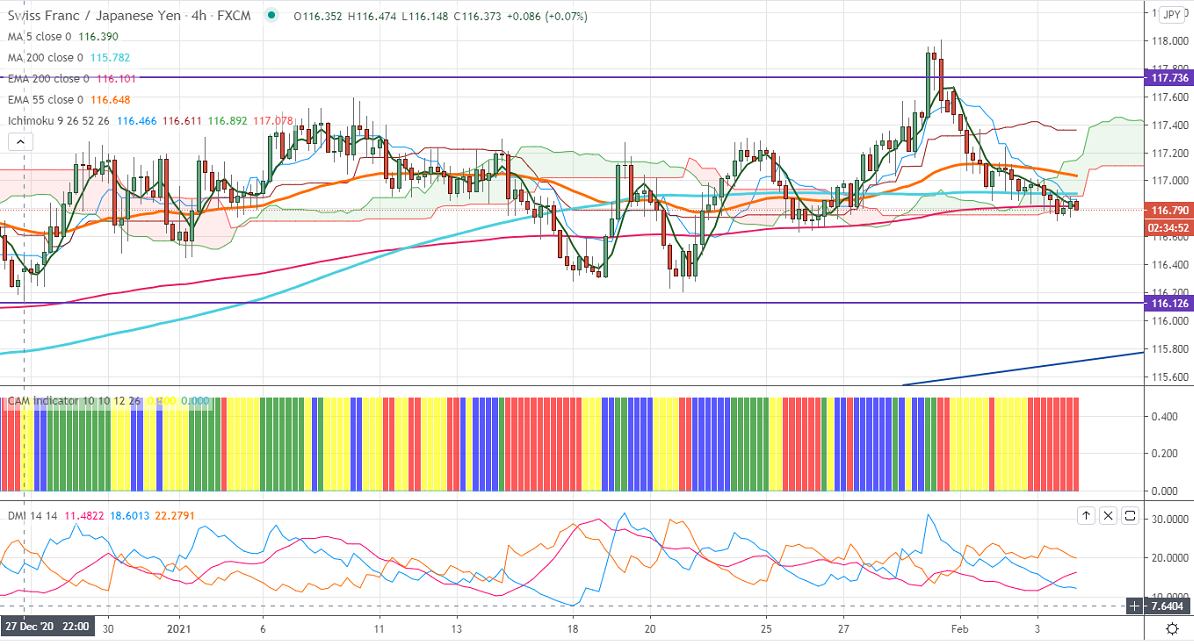

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 116.86

Kijun-Sen- 117.36

CHF/JPY continues to trade weak for the past four days on the weak Swiss franc. The pair lost more than 100 pips despite weak yen The intraday trend of CHFJPY remains bearish as long as resistance 118 holds.

USDCHF breaks significant resistance at 0.8925 and surged more than 80 pips on broad-based US dollar buying. The JPY is trading weak against the USD on fading safe-haven demand.

Technical:

The pair's strong resistance is at 117 violation above will take to the next level 117.35/118/118.60. On the lower side, near term support is around 116.70, and any indicative break below targets 116/115.84.

Indicator (4-hour chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around 117.25-30 with SL around 118 for the TP of 114.80.