Gold -

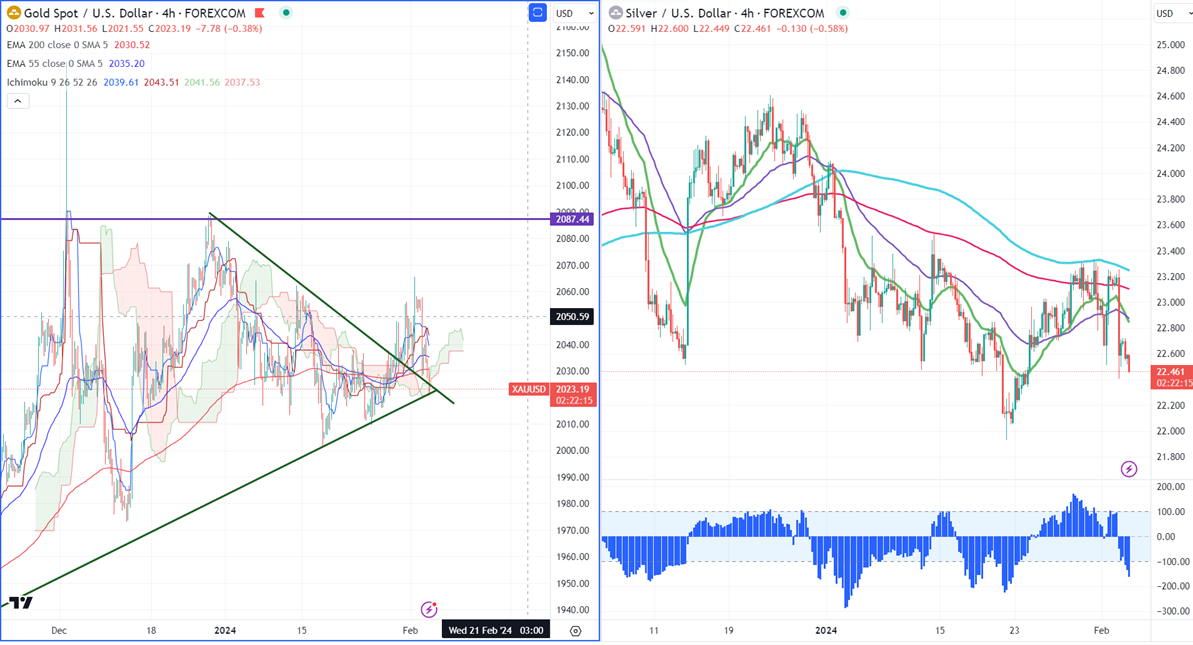

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $2042.64

Kijun-Sen- $2046.24

Gold pared most of its gains after stellar US jobs data. The US economy added 353000 jobs in Jan, compared to a forecast of 180000. Unemployment came in line with expectations of 3.70%. Wage inflation rose to 4.5% higher than the estimate of 4.1%. The chance of an early rate cut diminished after the US Non-farm payroll. The yellow metal hit a low of $2023 at the time of writing and is currently trading around $2023.52.

The number of people who have filed for unemployment benefits jumped to a two-month high of 224000 last week, below the estimate of 212000.

According to the CME Fed watch tool, the probability of a no-rate cut in Mar increased to 82.5% from 52.3% a week ago.

US dollar index- Bullish. Minor support around 103.50/102.75. The near-term resistance is 104.50/106.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $2020, a break below targets of $2000/$1970/$1956. The yellow metal faces minor resistance around $2040 and a breach above will take it to the next level of $2060/$2070/$2080/$2100.

It is good to buy on dips around $2000 with SL around $1970 for TP of $2065/$2080.

.

Silver-

Silver declined sharply due to the strong US dollar. It trades above 21 and 55- EMA and long-term MA (200- EMA) in the 4-hour chart. The near-term resistance is around $22.75 and a break above confirms an intraday bullishness. A jump to $23/$23.35 is possible. It is immediate support at around $22.40. Any break below target $21.90/$21.50.

Crude oil-

WTI crude oil prices tumble sharply despite the escalation of geo-political tension in the Middle East. the increase in production by major countries like the US, Canada, Guyana, and Venezuela.

Major resistance- $75/$78. Significant support- $70/$68.

Feb 5th, 2024, US ISM services PMI (1:30 pm GMT)

Feb 8th, 2024, US initial jobless claims (1:30 pm GMT)

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential