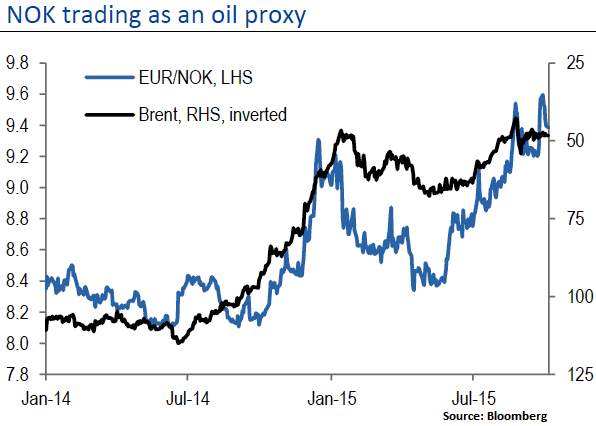

While oil prices will dictate the short term moves in NOK, the longer term NOK outlook will depend on the lasting effects of lower oil prices to domestic drivers. The depreciation in NOK in H2 2014 has underpinned inflation, but slower growth and lower domestic demand will drag prices lower once the FX effect starts to wane.

Providing support to domestic growth though is Norway's fiscal rule and the translational effect of a weaker NOK on Norway's sovereign oil fund, GPFG, that act as an automatic stabilizer. We can observe from the diagram how this currency cross is directly proportional to the oil prices.

This FX translational effect would have increased the government's fiscal scope by NOK 30bn in 2014, i.e., about 1% of mainland GDP-sums which the government can use to prop up the economy. As such, we are cautiously constructive on NOK and believe EUR/NOK can drift lower once oil prices are able to find a stable floor.

Hence, only a material recovery in oil prices is likely to stop those cutting rates to new historic lows. While this risk overhangs, we maintain a negative stance on the currency, with EUR/NOK expected to retest the recent highs around 9.60.

FxWirePro: Crude oil driving EUR/NOK’s trend

Tuesday, October 13, 2015 1:40 PM UTC

Editor's Picks

- Market Data

Most Popular

NZDJPY Range Breakout Watch: Bulls Target 94.00 as Technical Consolidation Tightens

NZDJPY Range Breakout Watch: Bulls Target 94.00 as Technical Consolidation Tightens  FxWirePro: EUR/AUD drifts lower, could be on verge of bigger drop

FxWirePro: EUR/AUD drifts lower, could be on verge of bigger drop  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  Institutional Fever: Is Bitcoin Gearing Up for a Historic 80,000 USD Run?

Institutional Fever: Is Bitcoin Gearing Up for a Historic 80,000 USD Run?  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro: GBP/AUD momentum strongly bearish despite pause in losses

FxWirePro: GBP/AUD momentum strongly bearish despite pause in losses  FxWirePro: EUR/ NZD stuck in range but maintains bearish bias

FxWirePro: EUR/ NZD stuck in range but maintains bearish bias  FxWirePro- Major European Indices

FxWirePro- Major European Indices  FxWirePro: USD/ZAR rebounds strongly, upside pressure builds

FxWirePro: USD/ZAR rebounds strongly, upside pressure builds  FxWirePro: AUD/USD firms as demand for the U.S. dollar eases

FxWirePro: AUD/USD firms as demand for the U.S. dollar eases  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Pound-Yen Steady: GBPJPY Bulls Gather Strength for a 212.00 Push

Pound-Yen Steady: GBPJPY Bulls Gather Strength for a 212.00 Push  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro: USD/JPY edges up, remains on front foot

FxWirePro: USD/JPY edges up, remains on front foot  FxWirePro: GBP/USD downside pressure builds, key support level in focus

FxWirePro: GBP/USD downside pressure builds, key support level in focus