As we expect the RBA to remain on hold for some time, but the RBNZ to ease again in March and June. Expected RBA vs RBNZ direction, plus strong M&A flow into the AUD, favours AUD/NZD upside over the next few months to beyond 1.10.

Please be informed that in our previous write up the strips were made unloaded on 8th Feb. Refer to this article.

After going through the above article, we hope you were convinced as to why we've suggested to unload the weights in strip strategy if you compare the prevailing upswings of AUDNZD with the current price is at 1.0791. However, those who altered the strategy into debit put spread so as to suit the leftover bearish swings that would have hedged the dips upto the bottoms at 1.0570, rest is history.

But for now, the pair has pretty much responded as per earlier analysis and we could now foresee some more price bounces in near term as the daily technical chart suggests some sort of buying interest that would result in considerable price recoveries but we maintain our 1st target at 1.0905 levels towards north, upon breach of this level where it would likely to test resistance, 1.10 is also quite probable event.

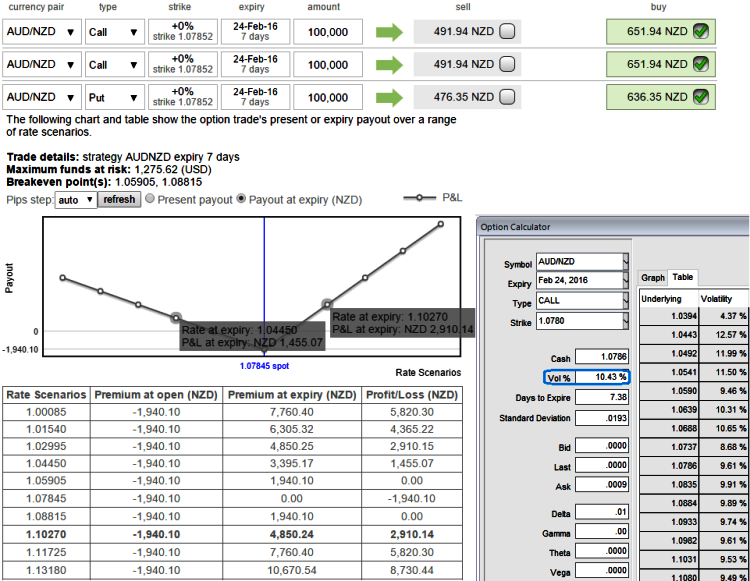

Thus, both on hedging and speculative grounds we recommend building portfolio with longs positions in 1w ATM 0.50 delta calls, 2W (1%) OTM 0.31 delta call and 1 lot of 4D -0.49 delta ATM puts. (For demonstrated purpose only we've used identical expiries in the diagram).

Hence, this AUDNZD option straps strategy should take care of any abrupt downswings in short term and certain upswings and yields handsome returns in long term. Delta of far OTM options is very small which is why we've chosen ATM instrument on call. A 1-point movement in underling pair will not have much effect on the option premium.

FxWirePro: Deploy diagonal straps to keep AUD/NZD's puzzling swings on check

Wednesday, February 17, 2016 5:56 AM UTC

Editor's Picks

- Market Data

Most Popular