Technical watch:

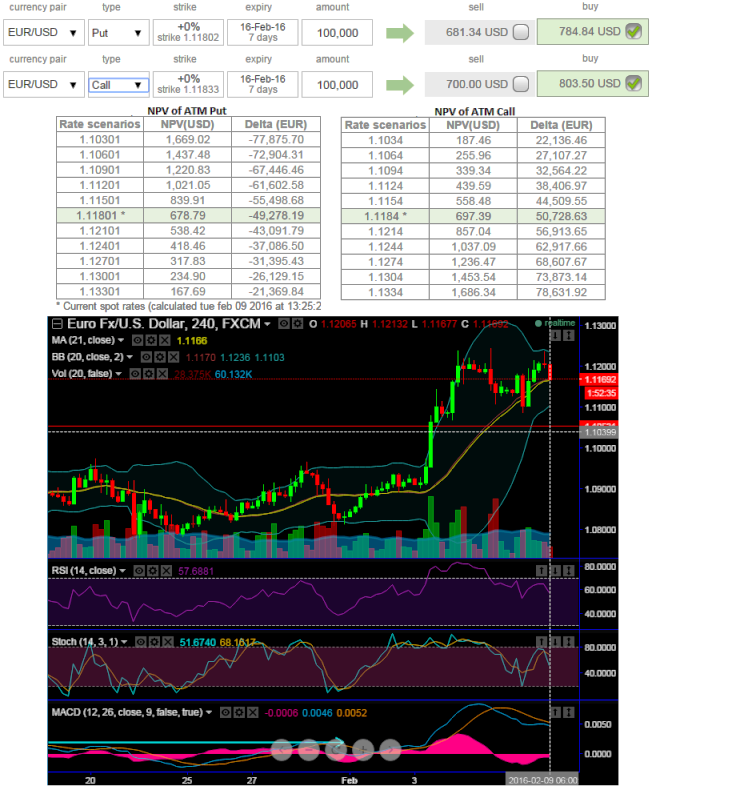

The reducing pace in EURUSD's uptrend acceleration is reckoned as the momentary depiction of the intraday speculation. Yes, we could merely perceive this as a speculative dips, when you plot the 4-hourly charts you may probably get convinced with this stance.

Both on daily and intraday charts, price dips are not in conformity to the substantial volumes that shows there is speculation going on in the spot FX ahead of tomorrow's Yellen's speech monetary policy minutes.

Both daily and weekly charts sends messages as to the current bullish swings remain intact as the prices curve has been hovering well above 21DMA consistently. And we can trust upon weekly price bounces as it is boosted by healthy volumes build up.

In between, the pair has has just crossed above 21 moving average while leading and lagging indicators moving in line with price spikes to show upward convergence. Even though you may probably get to see some minor corrections, this wouldn't be deemed as a shorting opportunity.

Instead, speculate with the bull put spread option trading strategy when you ponder over the price of this underlying pair would remain slightly edgy or go up moderately in the near term.

We observed ATM puts are overpriced than ATM calls to the Net present value.

ATM premiums of puts are trading 15.62% more than NPV, while ATM premiums of calls are trading at 15.2% more than NPV.

Hence, by shorting 4D a higher striking ITM puts likely to fetch handsome gains and it finances to cushion while going long in 2W lower striking OTM put (both are to be European style options).

Well, if the EURUSD spot FX closes above the higher strike price on expiration date, both options expire worthless and the strategy derives the maximum returns which is equal to the credit taken in when entering the position.

FxWirePro: Don’t bear trapped in EUR/USD, capitalize on dips to speculate with bull put spreads as ATM puts priced than calls to NPV

Tuesday, February 9, 2016 8:11 AM UTC

Editor's Picks

- Market Data

Most Popular