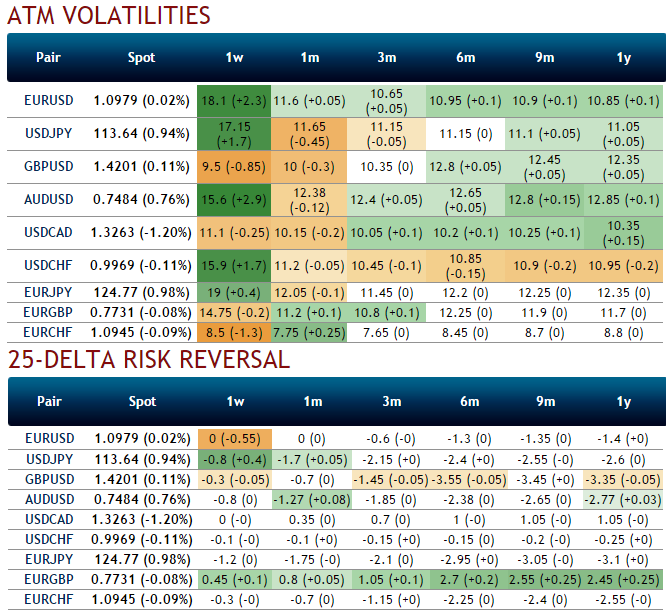

The IVs of euro crosses are extremely volatile, especially the current IVs of 1W EURJPY ATM contracts are at the highest levels at 19% which is among G20 currency space and likely to perceive on an average of 12.5% in long run would divulge pair's gain (see 1W-1Y ATM IVs).

Technical glimpse: The long term trend of this pair has been downtrend with stiff resistance at 125.546 levels, this has been evident on monthly chart as the current downswings on monthly charts are moving in sloping channel and fell below moving average curve.

To substantiate this view the RSI (14) on daily chart has been evidencing downward convergence that signals selling momentum. While slow stochastic curve approached oversold zones but no traces of buying interest. Overall, the major downtrend dominated by the bears with clear volume confirmation.

This reasoning is in sync with the OTC hedging activities as the delta risk reversals increasing up progressively with negative numbers signify hedging sentiments are well equipped for downside risks over the period of time.

So, buy 2W (-0.5%) out of the money vega put options and short 1W (1%) in the money call option.

Here, by employing 1W ITM call writing in our strategy is an extra advantage in hedging cost and to match both higher implied volatilities and delta risk reversals.

In this instance, let's suppose in 1weeks' time EURJPY keeps drifting southwards from current levels of 124.459 or stay stagnant or even spikes but certainly not above (1%) within 1 week, then ITM shorts would expire worthless and likely to fetch you the certain yields.

But, remember to have the reasonable Vega of a long put option position, because these HY IVs will have predominant role in option premiums, if it increases or decreases by 1%, the option's premium will proportionately increase or decrease by respective vega values.

FxWirePro: EUR/JPY IVs mounting in sky rocketed pace, highest among G20 space - vega spreads for tackling HY vols

Thursday, March 10, 2016 8:18 AM UTC

Editor's Picks

- Market Data

Most Popular