We think that not only the risks appear in euro zone matters for tomorrow's ECB monetary policy but the fear of broader global risks now appears majorly to outweigh worries about further ECB policy easing.

Given concerns on limits of the policy arsenal at the BoJ and rising euro-centric risks, we recommend initiating short EURJPY positions for long term hedging but by capitalizing on every short term upswing, preferably via options ahead of this and June ECB meetings.

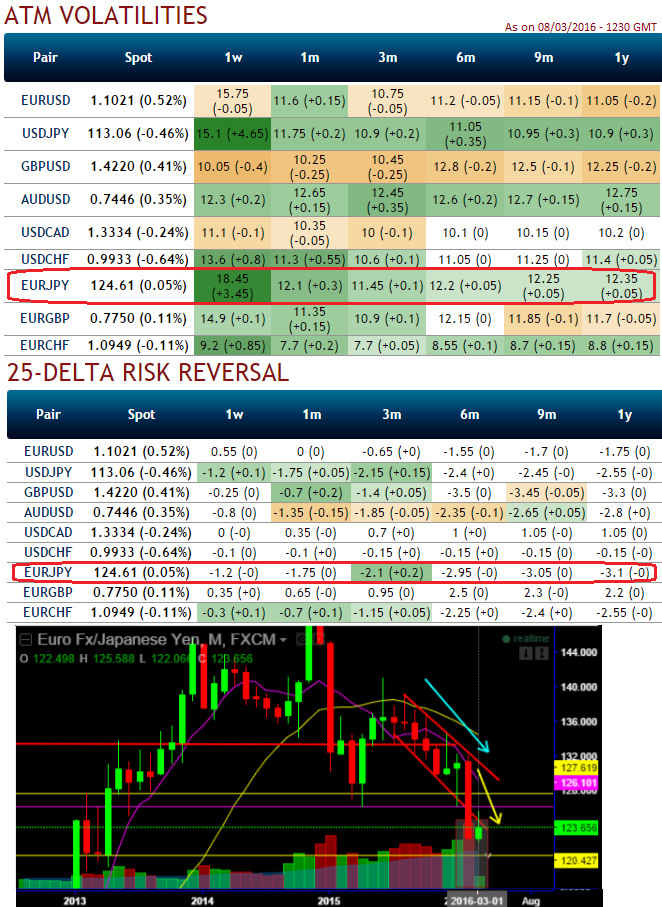

Despite acknowledging the recent uptick in the implied volatility of Euro crosses, especially EURJPY with higher negative risk reversal is justifiable when you have to observe the spot curve of this pair (see IV and RR nutshell and compare this with spot prices).

Technically, our bearish view in long-term for EURJPY was encouraged by the break below strong supports 126.00 1st and now breach of channel support at 122.498 with huge volumes conformity, near the 2015 lows. Lack of upside traction following the January uptick points to further weakness in the coming weeks. After these break outs with leading and lagging indicators convergence, we can understand the intensity of momentum in prevailing bearish trend as we recently saw a breach of channel support as well.

Contemplating above technical reasoning and the implied volatility of ATM contracts for near month expiries of this the pair is at around 18.45% for 1W contracts which is the highest among G10 currency space, we eye on loading up with fresh longs for long term hedging, more number of longs comprising ATM instruments and ITM shorts in short term would optimise the strategy.

We already stated the delta risk reversals increasing up progressively with negative numbers, we now reiterate OTC set up signifies the hedging sentiments are well equipped for downside risks over the period of time.

While current IVs of ATM contracts are at higher levels but likely to perceive on an average of 13% in long run would divulge pair's gain (see 1W-1Y ATM IVs).

Since more downside risks are still on the cards in long run, as result of deploying ATM delta instruments would be the answer for both speculation and hedging if you think speculation in abrupt upswings in short terms is not possible as delta risk reversal suggested puts have been overpriced then use OTM puts that are available in cheaper premiums comparatively.

So, the strategy goes this way, short 1W (1%) OTM put option, go long in 2 lots of 1M ATM +0.49 delta put options.

With set these narrow strike differences, because the profit potential is greater, so that the ratio needed is also lower to profit on underlying movement. You want to take this trade if you think this pair can go lower, but not crash below 1% strikes (the OTM shorts).

Caution: If you think the pair is going to crash, you should be loading up on put buys in existing strategy. The total cost of the trade is going to be the difference between the prices of the two options.

FxWirePro: Extreme negative OTC sentiments, IVs spiking crazily, technicals signal EUR/JPY's weakness, only PRBS can offer optimal hedging

Wednesday, March 9, 2016 6:06 AM UTC

Editor's Picks

- Market Data

Most Popular