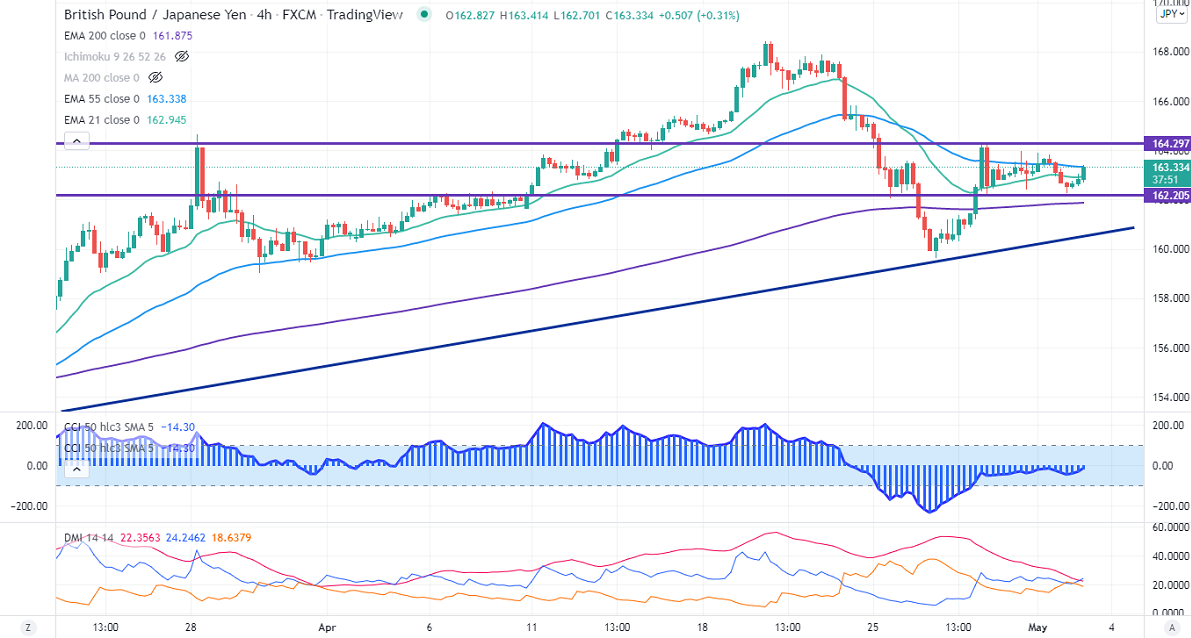

GBPJPY consolidating in a narrow range between 164.25 and 162.28 for the past three days. Pound sterling regained above 1.25500 ahead of the US FOMC meeting and BOE. The overall trend of GBPUSD is weak on policy divergence between central banks. Any breach above 1.26250 confirms further bullishness. GBPJPY hits an intraday high of 163.41 and is currently trading around 163.289.

USDJPY

USDJPY holds above 130 ahead of Fed policy. The intraday weakness is only below 129.

Technicals:

On the lower side, immediate support is around 162, breach below will drag the pair to the next level to 159. The minor resistance to be watched is around 164.25, a break above that level confirms intraday bullishness, and a jump to 165/166/168 is possible.

It is good to sell on rallies around 164.10-20 with SL around 166 for the TP of 159/156.