FxWirePro- GBPJPY Daily Outlook

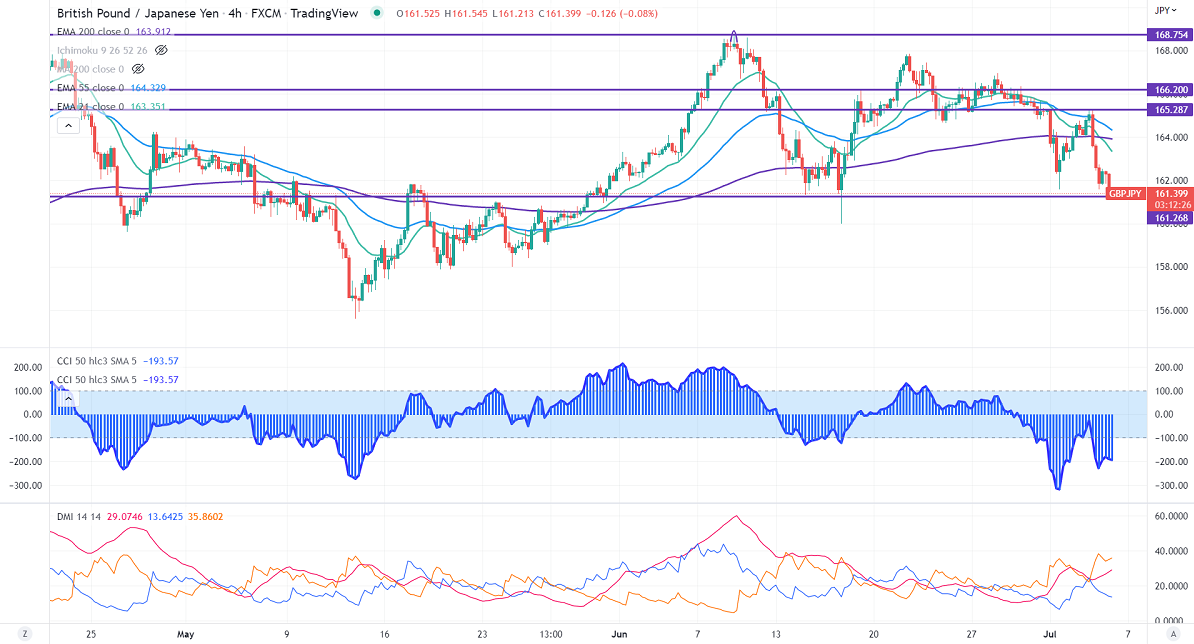

GBPJPY declined sharply and lost more than 350 pips from yesterday's high of 165.21. The pound sterling tanks below the 1.2000 level on board-based US dollar buying and BOE pessimistic report on UK economic outlook. Any daily close below 1.19000 confirms a bearish continuation. Technically in the 4-hour chart, the pair is holding below 21-EMA, above 55 EMA, and long-term 200 EMA (163.93). Any break below 160 will drag the pair down to 158.25/157.15. GBPJPY hits an intraday low of 161.28 and is currently trading around 161.35.

The near-term resistance is around 162, any breach above targets 163/163.75/165.

Indicators (4-hour chart)

CCI (50) - Bearish

ADX- neutral

It is good to sell on rallies around 162.15-20 with SL around 163.25 for TP of 158.25.

FxWirePro- GBPJPY Daily Outlook

Wednesday, July 6, 2022 5:49 AM UTC

Editor's Picks

- Market Data

Most Popular