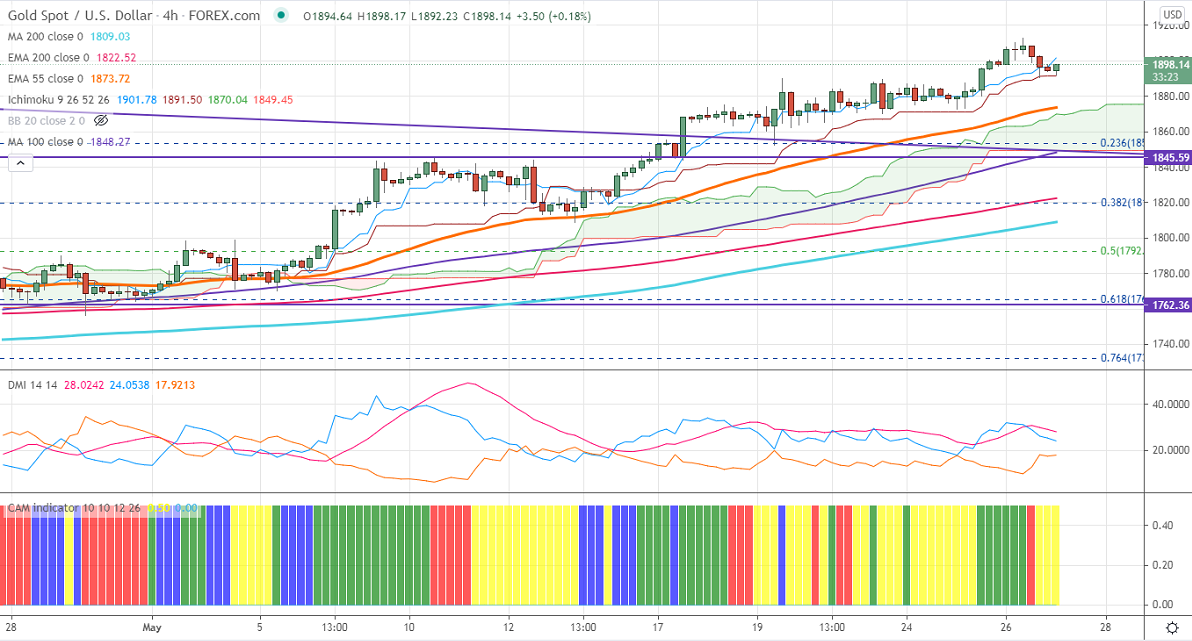

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1896.50

Kijun-Sen- $1891.50

Gold lost more than $10 after hitting a multi-month high of $1912 on the strong US dollar. US dollar index recovered sharply from a low of 89.53 and trading slightly above 90 levels. The US-China trade optimism is putting pressure on the yellow metal at higher levels. The US 10-year bond yield jumped more than 2% from the recent low of 1.552%. The yellow metal hits an intraday high of $1897.88 and is currently trading around $1897.62. Markets eye US Prelim GDP, Core durable goods orders, and pending home sales for further direction.

Technical:

It is facing strong support at $1890, violation below targets $1875/$1860/$1850. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1920, any convincing break above confirms bullish continuation. A jump to $1932/$1959 is possible.

It is good to buy on dips around $1878-80 with SL around $1860 for the TP of $1932.