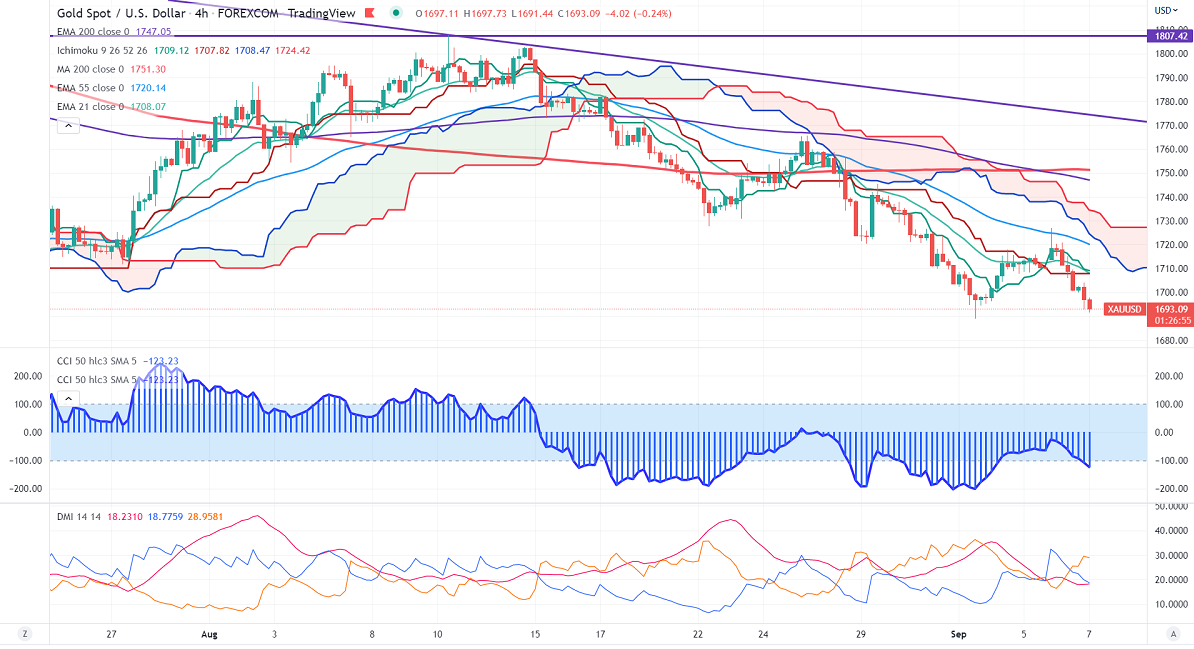

Ichimoku Analysis (4-hour Chart)

Tenken-Sen- $1709.78

Kijun-Sen- $1707.82

Gold pared most of its gains on the strong US dollar. The greenback surged sharply and hits a fresh 20-year high on the robust US ISM services index. It came at 56.90 in Aug compared to a forecast of 55.40, the second consecutive monthly increase. The surge in US 10-year bond yields also puts pressure on the yellow metal at higher levels.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Sep dropped to 74% from 73% a week ago.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index – Bullish (Negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1690, a close below targets $1671/$1650/$1600. Significant reversal only below $1650. The yellow metal faces minor resistance around $1720, breach above will take it to the next level of $1740/$1760/$1775/$1800/$1820.

It is good to buy on dips around $1678-80 with SL at around $1650 for TP of $1750/$1775.