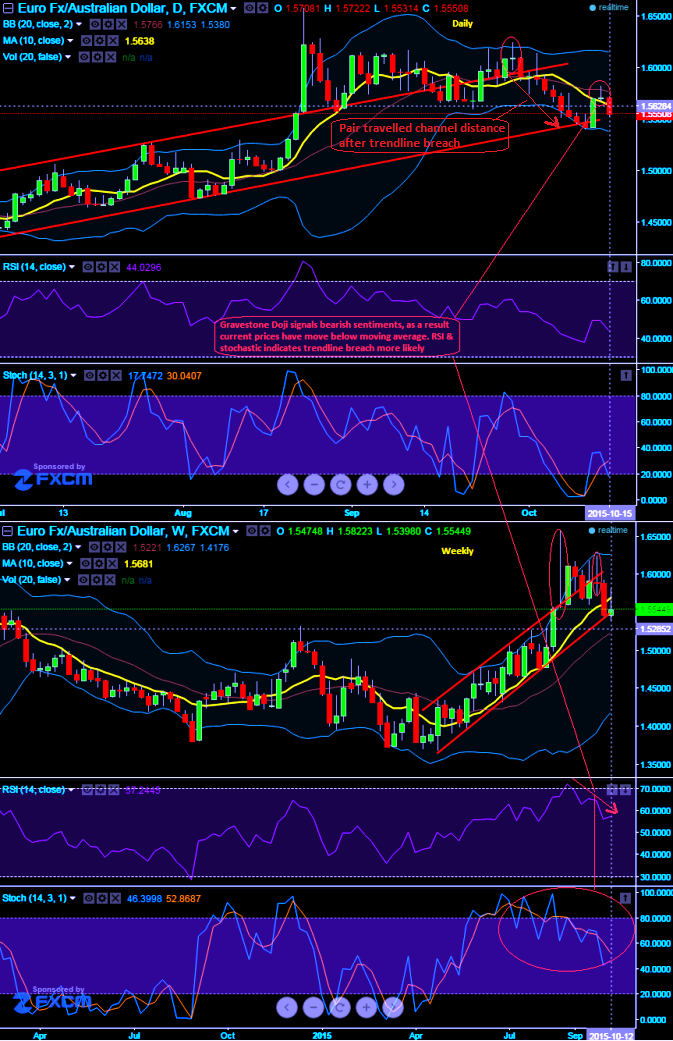

Our earlier targets of 1.5696 levels are achieved after the formation of last week's long real body bearish candle. But for now we again like to reiterate even though prices are showing strength today it is falling well below moving average curve.

More importantly we spotted out a gravestone pattern again at 1.5708, so we believe with this bearish indication the pair to either remain stagnant or drag towards 1.5475 levels if it breaks current levels of 1.5554 which is a trendline support. If it manages to hold these levels then it would bounce back again. But in our opinion it is better to use these rallies and stay calm with earlier ITM long puts instead of fresh long build ups.

RSI curve is currently trending at 44.6925 and an attempt of %D line crossover near 30 level (current %D is at around 30.9255 and %K is at 20.6366) on daily charts.

You can observe the pair has broken channel line support earlier at around 1.5917 levels previous to which it has formed spinning top as well and travelled the channel line distance but now inching towards little upwards slowly, while weekly leading oscillators puzzle by signaling bearish trend as they are converging downwards to the dropping prices.

FxWirePro: Gravestone doji to evidence EUR/AUD’s further slumps – trendline breach likely

Thursday, October 15, 2015 8:50 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K