Option Currency Hedging and speculating:

For today, no doubt upswings are attempting to bounce above 21DMA but casted-off at 181.205 levels on this pair in abrupt but any continued downswings may turn adversely as we think the current downtrend holds stronger, so we've tailored our formulation of strategies as the risk appetite varies from different investors to different traders.

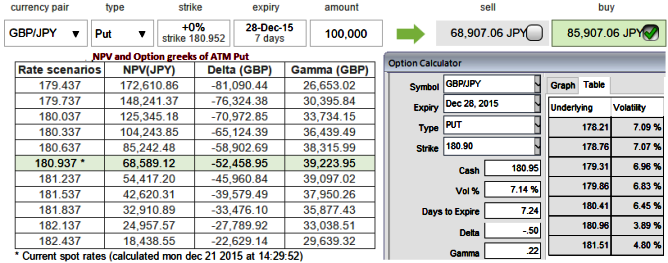

The naked at the money put option with 7 days expiry was highly sensitive to moves in the underlying exchange rate of GBP/JPY when gamma was at around 0.39.

1W ATM volatility is perceived at 7.14% and it is likely to increase in long run (for next 6 months to 1-year span).

Because in the sensitivity table gamma shows how much the delta will shift for a corresponding underlying rate moves by 1%.

With reducing volatility gamma adds to the risk and reward profile for both holders and writers.

Thus, on a hedging perspective in long term, using gamma factor in order to neutralize volatility factor, put back-spreads are advocated so as to reduce the sensitivity and focus on hedging motive.

Hence, go long on 2W 2 lots of at the money -0.50 delta puts with gamma at 0.39 and simultaneously shorting 3D Out-Of-The-Money put option is recommended to reduce the cost of hedging by financing long position in buying At-The-Money Puts.

However, speculators no worry to break your head, one touch 0.47 delta calls will come in your way to add leveraging effects of today's rallies but don't expect targets not more than 181.215, play these instruments for anything below these levels.

FxWirePro: Hedge GBP/JPY downside risks via back spreads and speculate via one touch binary calls

Monday, December 21, 2015 9:21 AM UTC

Editor's Picks

- Market Data

Most Popular