The Kiwis central bank (RBNZ) left the stance of monetary policy broadly unchanged today, as widely anticipated. The RBNZ’s headline was that a further easing in monetary policy has been delivered. But it is “further” only in the sense that the RBNZ has been explicit about the long timeframe over which it intends to buy bonds under the LSAP. The rate at which it intends to buy bonds has not changed, so we would say that the stance of monetary policy has not changed.

However, the RBNZ has provided useful clarity to markets, both about the future of the LSAP and about its readiness to deploy a negative OCR.

The RBNZ expanded the cap on the Large-Scale Asset Purchase (LSAP) programme from $60bn to $100bn. But that is not necessarily a monetary easing, because the new timeframe over which the purchases will be conducted is much longer. Previously the LSAP programme was $60bn by May 2021, which implied an average weekly purchase pace of around $900m per week. Now the LSAP now $100bn by June 2022, which implies an average purchase pace of only $800m per week. Describing the LSAP as a larger number over a longer timeframe does do two things: 1) it gives the RBNZ more flexibility to frontload purchases if necessary; and 2) it provides more certainty to the market.

NZDUSD price plunges below 0.65 levels as bears are intensified as predicted in our recent posts.

OTC Updates and Hedging Strategies:

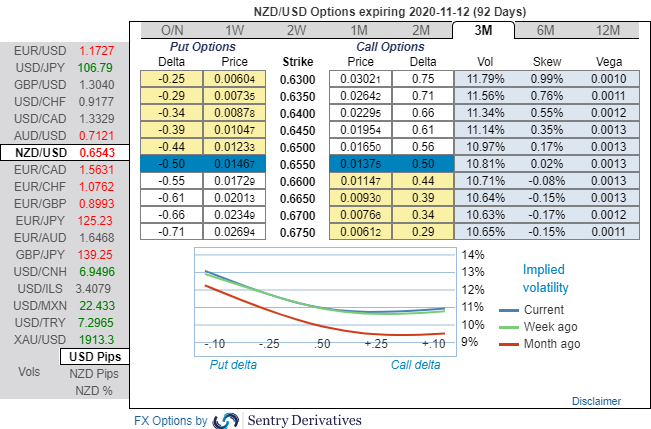

Let’s now quickly glance through OTC updates before deep diving into the strategic frameworks of NZDUSD. The pair is showing higher IVs among G10 FX bloc (3m IVs are in between 10.65 – 11.79%).

IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility, and it is quite impossible for any veteran to ascertain accurate future volatility.

The skewness of 3m IVs still signals extreme downside risks, bids for OTM put strikes are quite visible (up to 0.63 for these tenors, refer above chart). Based on above-mentioned fundamental factors and OTC outlook, diagonal debit put spreads are advocated on RBNZ’s post monetary policy effects, the strategy is designed to mitigate the downside risks with a reduced cost of trading.

The execution: Short 1m (1.5%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options capitalizing on the minor upswings in the short-run.

Alternatively, we recommend short hedges staying shorts in NZDUSD futures contracts of September’20 delivery with a view of arresting bearish risks in the major trend (spot reference: 0.6545 level). Courtesy: Sentry & Westpac

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes