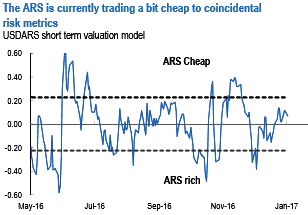

We encourage holding longs in ARS, short USDARS. The peso is currently trading a bit cheap to coincidental risk metrics (refer above chart), helped by soy prices, the positive real rate enforced by the Central Bank to prevent further inflation expectations de-anchoring, and high agricultural export proceeds for the season of the year.

The trade balance posted a US$2.1bn surplus in 2016, a sharp turnaround from the US$3.0bn deficit in 2015.

Imports contracted US$4.1bn last year, explaining 81% of the swing in the trade balance.

2016 primary fiscal deficit (ex.-tax amnesty fiscal inflows) was 6.0% of GDP, well above our 5.0% forecast.

Short USDARS, we remain constructive on ARS and continue to recommend selling 3m and up to 6m USDARS NDF as one of the few carry trades where we expect the positive total return.

The recent macro news supports this outlook, as our nowcaster suggests that Q4’16 GDP expanded by 5% QoQ SAAR, materially better than our prior 3.2% forecast.

Stay short in USDARS via 6-month NDF (sell at 15.86).

Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons

Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence