Potential event risks: Kiwis Q4 terms of trade is expected to rise 4%, driven mainly by the 2016 surge in dairy prices, with subdued import prices adding to the mix. There’s little fresh news in the data, which is why the market hardly ever reacts to it.

China: Feb Caixin and Markit PMI release with the index currently showing a positive trend in services whilst manufacturing has returned to its long-run trend.

NZ GDP Q4 print is scheduled to be released on March 15th.

BoJ monetary policy on March 15th.

RBNZ monetary policy scheduled on March 22nd that announces OCR.

OTC updates and hedging framework:

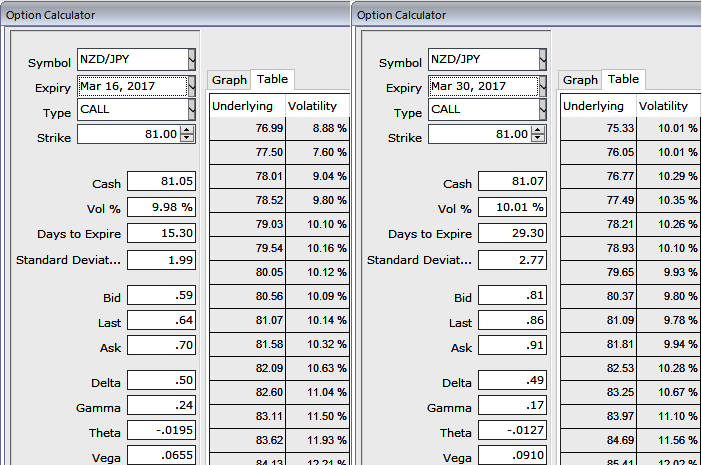

Please be noted that the 1m IVs are trading at around 10.01%, while 2w IVs are around 9.98%. The 1-month is to encompass all the above-mentioned data events. Despite the fact that the significant data events are lined up, you see dramatic movements in IVs which is good news for option writers.

In NZDJPY, if you're a sceptic on ongoing rallies to have a restricted upside potential (as stated in our technical write up, the stiff resistance at 83.762 levels) and expects abrupt declines then the below strategy is advisable. Visit our below web link for more reading on technicals of this pair:

Well, we expect NZD to fall through this year, reaching 74.800 against JPY by end of Q3 and even up to 69.313 at year-end. The support to growth from migration will fade, while the RBNZ -at the very least–are likely to hold rates steady as inflation normalizes, pushing real rates materially lower.

Ideally, the below option trading strategy is constructed for those who have exposures in spot FX of this underlying pair while, simultaneously, buying a protective put and shorting calls against that holding.

The strategy goes this way: while you're holding longs in spot FX of NZDJPY, go short in 2W (1.5%) OTM striking call and long in 1m (1%) OTM striking put. Since the short term, bullish sentiments are mounting we kept upside bracket little on the higher side.

Options with a higher IV cost more which is why in this case OTM puts have been preferred over ATM instruments. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good.

On the flip side, when you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

Use above mentioned IVs (2w1m) for both short and long legs respectively. This strategy is the best suitable if you're writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying spot FX.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand