The pair has broken trendline support at 0.6619 yesterday showing further weakness. We could foresee the next strong levels of support only at 0.6541.

This has struggled and failed to hold onto 0.6619 levels which has acted as crucial support and resistance in the recent past as well.

Long term Hedging Perspectives:

When all eyes tend to drag this currency towards further slumps and eyes on bearish instruments (puts obviously tend to be costlier), on a long term perspective, contemplating the above critical support we build neutral calendar spread on this pair favoring potential downside risks.

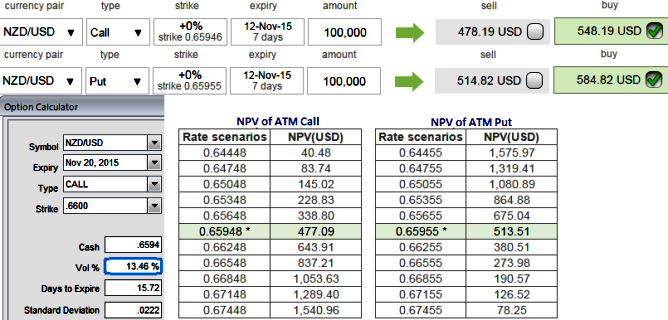

As the volatility near month ATM contracts of NZD/USD ATM contracts is to perceive at 13.46% which is comparatively higher in APAC currency baskets except AUDUSD.

Deploying customized calendar combination using ATM call shorts at current juncture is more suitable considering when puts seem overpriced.

Here, idea is not to go against the trend but on hedging grounds, strategy goes this way-

Kiwi dollar after a long lasted losing streak that was started from last 1 year or so to hit almost 6 year's lows has now changed its direction. Buy 2m (mid month) at the money -0.5 delta put and simultaneously short 1w near month contract (1%) in the money call with positive theta value.

As shown in the diagram when IV is 13.46%, ATM call seems to be overpriced (premiums trading more than 14%, while puts are 13%), as a result with trend being bearish shorting calls would finance the long positions in puts.

On speculative grounds, one can initiate even fresh shorts at current levels keeping 0.6619 as strict stop loss for the target of 55 to 60 pips.

FxWirePro: NZD/USD calendar combinations to reduce hedging cost

Thursday, November 5, 2015 7:16 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: USD/ZAR edges higher but bearish outlook persists

FxWirePro: USD/ZAR edges higher but bearish outlook persists  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: GBP/AUD key support held, downside risk remains

FxWirePro: GBP/AUD key support held, downside risk remains  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro- Major European Indices

FxWirePro- Major European Indices  ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000

ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000  FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish

FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish  FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook

FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook  FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside

FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside  FxWirePro: GBP/AUD extends drop, vulnerable to more downside

FxWirePro: GBP/AUD extends drop, vulnerable to more downside  FxWirePro: EUR/NZD recovers slightly but bears are not done yet

FxWirePro: EUR/NZD recovers slightly but bears are not done yet  NZDJPY Retraces on Tokyo CPI: Bulls Eye 95.00 Target as Support Holds

NZDJPY Retraces on Tokyo CPI: Bulls Eye 95.00 Target as Support Holds  Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize

Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize  FxWirePro: USD/JPY dips as yen gains after Tokyo CPI data

FxWirePro: USD/JPY dips as yen gains after Tokyo CPI data  FxWirePro: GBP/USD slides as UK political uncertainty weighs on pound

FxWirePro: GBP/USD slides as UK political uncertainty weighs on pound