The AUD/USD and USD/CAD belong to the commodity block and are sensitive to common factors like Fed policy, commodity prices and China growth. The relationship is currently not linear, meaning that one pair reacts more than the other to their common drivers.

Suppose that you buy AUDUSD ATM put options and sell ATM calls of USDCAD. Thereby, in the bearish scenario, the positive payoff on AUDUSD should exceed the positive payoff on USDCAD. This time, the bullish scenario in USDCAD is neutral with both options expiring out of the money.

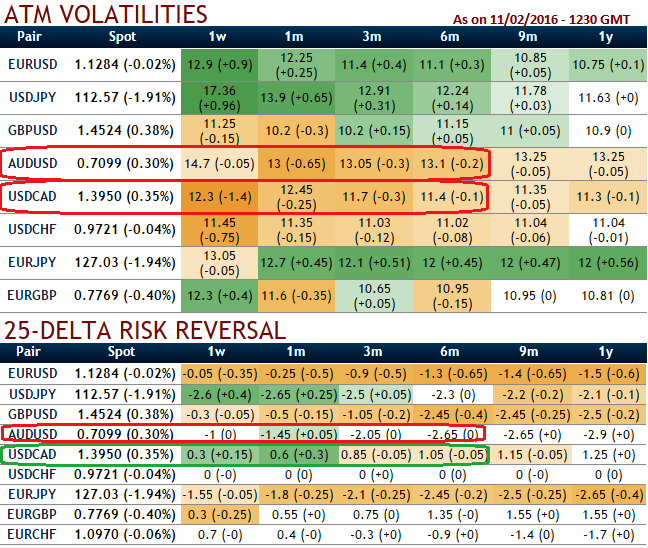

The AUD/USD has been more highly volatile than the USD/CAD (see ATM vols charts), partially because of its larger carry which justifies a higher level of risk. Therefore, a fall in the AUD is very likely to exceed a fall in the CAD, provided that their positive correlation holds.

Buying an AUD/USD ATMS put financed by a USD/CAD ATMS call has always been a costly strategy given the positive volatility differential. This net cost is justified by the higher expected gain on the AUD leg, so fair market pricing is supposed to offset extra gains.

In current market conditions, investors selling a 1M USD/CAD ATMS call (strike 1.3975) would receive a premiums. However, buying a 2M AUD/USD ATMS put (strike 0.7080) would cost little expensive (both premiums in USD), but the net cost of the package would be reduced comparing naked positions pricing both bearish scenario in AUDUSD and bullish potential in USDCAD.

Reducing the cost by lowering the AUD/USD strike would alter the directional profile of the trade. If we make it zero cost that way, the difference between the strikes of the two options would directly offset the potential extra AUD gains since the AUD put would require a larger currency depreciation to be in the money. Instead, we keep ATMS strikes and cheapen the long put via a distant downside knock-out.

FxWirePro: Offset AUD's downside risk with CAD via zero cost combos- buy AUD/USD ATM puts with RKO shorts in USD/CAD ATM Puts

Thursday, February 11, 2016 1:19 PM UTC

Editor's Picks

- Market Data

Most Popular