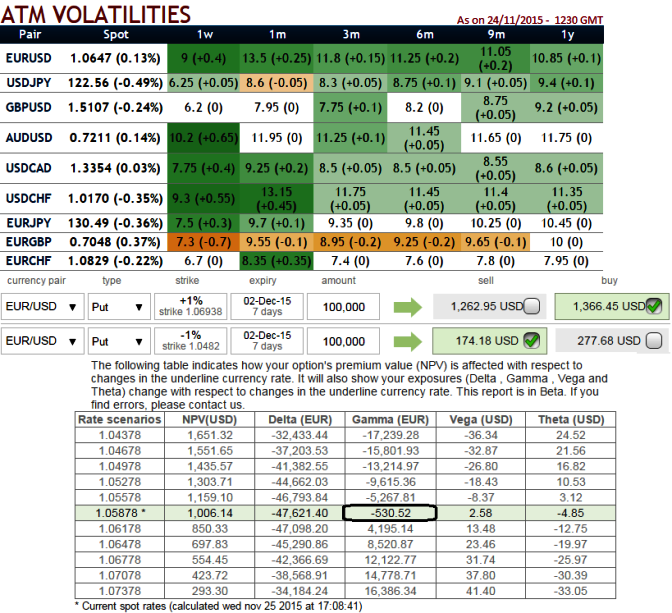

The implied volatility of the ATM contracts of EURUSD is spiking highest among G7 currency pairs amid the speculation on monetary policy decision by Fed. We see 13.5% vols for ATM contracts with 1m expiry which is the highest.

Hedging framework using naked contracts would turn out to be a gamble on those currency pairs whose implied volatility would be spiking up drastically (from the nutshell one can observe, EURO currency crosses except EURCHF are the ones whose IVs are increasing consistently).

Hence a lot of spreads have been drawing up some customized strategies by synthesizing both risk reversals and vols while looking upon the Option Greeks simultaneously. While doing so it seems like the FX options involving euro have tons of Gamma.

For an instance, we've considered EUR/USD's downside risks, and this can be mitigated by sparing little time on ascertaining an accurate gamma.

As you can observe from the diagrammatic representation, we've constructed put spread by considering gamma somewhere closer to zero that would neutralize the implied volatility impact on option price.

This position remains quite firm to achieve our hedging objectives (we've used price band between 1.0693 - 1.0482), because we know gamma represents the change in delta, we still have healthier delta at -0.47.

This spread results in desired hedging objective irrespective of implied volatility disruptions as we have both ITM and OTM instruments on long and short side respectively and prevailing bear run will be taken by In-The-Money puts.

Gamma of ATM options near expiry increases, whereas the Gamma of ITM and OTM options decreases. The chart below shows the behavior of Gamma relative to time until expiry and the option's moneyness.

FxWirePro: Optimize Euro implied volatility via gamma spreads

Wednesday, November 25, 2015 11:47 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro: USD/CAD steadies around 1.3680,retains bid tone

FxWirePro: USD/CAD steadies around 1.3680,retains bid tone  FxWirePro: USD/ZAR edges higher but bearish outlook persists

FxWirePro: USD/ZAR edges higher but bearish outlook persists  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside

FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside  FxWirePro: USD/CAD changes short term trend from neutral to bearish

FxWirePro: USD/CAD changes short term trend from neutral to bearish  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro: NZD/USD edges up, remains on front foot

FxWirePro: NZD/USD edges up, remains on front foot  FxWirePro- Major European Indices

FxWirePro- Major European Indices  ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000

ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000  FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish

FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  AUDJPY Reclaims 111 Handle: Bulls Eye 112 Target After Dip

AUDJPY Reclaims 111 Handle: Bulls Eye 112 Target After Dip  FxWirePro: GBP/USD slips ahead of Manchester local election

FxWirePro: GBP/USD slips ahead of Manchester local election  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary