Following the end of the rate hike cycle in Mexico, the markets are now speculating when the first rate cut may follow. Against this background, today’s publication of the inflation report, as well as a speech by central bank governor Augustin Carstens, are of interest. In view of the still high inflation rate of 6.4% speculation of this nature seems premature to us though.

We believe that the central bank will no doubt want to be sure that inflation is moving towards the inflation target of 3% in a sustainable manner before taking a first rate step, and as a result we expect a lengthy rate pause. That means there is unlikely to be any momentum for the peso on this front. Instead, the NAFTA renegotiations might stir things up a little bit for the currency.

The second round of negotiations is scheduled at the end of this week. However, (negative) effects on the peso are likely to be limited. Recent comments on the part of US President Donald Trump, which once again suggested that the agreement might come to an end, only put short term pressure on the peso. The general point of view that the agreement is likely to remain in place in the future was not affected by this sabre rattling.

But investors may become a little more nervous and take a cautious approach towards MXN engagements. USDMXN is likely to trend sideways again in the near future.

The peso has come a long way from its Trump lows and screens overbought and overvalued at current levels, leading our LatAm team to turn underweight recently.

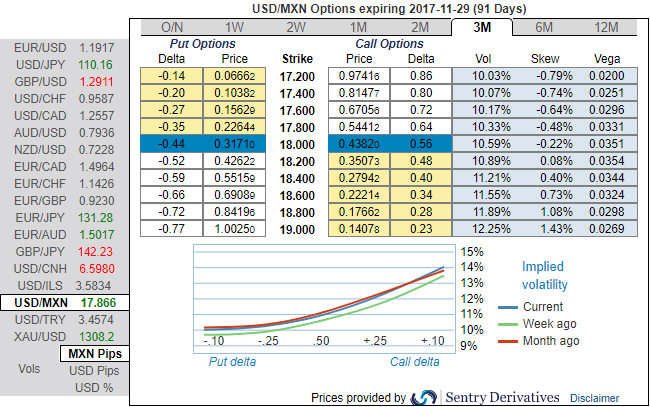

The standout feature of the USDMXN vol surface to us is the cheapness of risk-reversals, both vis-à-vis ATM vols and particularly relative to the amount of carry in forwards that allows for carry efficient expressions of bearish directional views or tail risk hedges.

Please be noted that the 3m IVs of USDMXN are indicated bullish risks, the telling statistic from the graphic is that that the static carry of delta hedged vega-neutral 3M skews is a very substantial 2.5 vol pt., near the upper-end of its 2-yr range.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand