Technical glance:

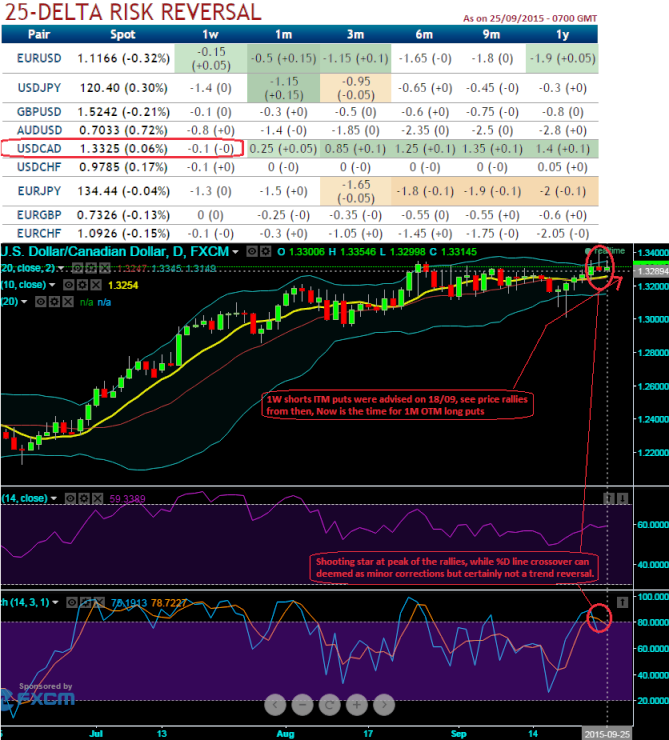

As an evidence of the below recommendation, we traced shooting star yesterday at 1.3300 levels that signal intermediate correction is underway in near future ahead. The formation of this bearish pattern candle at peak is piling up some sort of selling pressures now. Currently, the pair is lingering at 1.3326, RSI curve on weekly is trending at 73.5503 facing towards south, while %D line 91.6013 and %K line at 93.2121. Hence, although it is not going to be steep slumps or long term trend reversal we would still foresee near targets at around 1.3239 areas first and can even extend upto 1.3172 levels in near terms with a strict stop loss at 1.3385 levels.

Assured returns on shorts: By now, our 1W shorts on back spreads would have achieved desired returns as the pair rallied from 1.3013 levels on 18th upto 1.3416 (highs of this week)

Please refer for further readings:

http://www.econotimes.com/FxWirePro-Hedge-USD-CAD-with-PRBS-as-delta-risk-reversal-projects-intermediate-term-trend-reversal-91042

Currency hedging framework: USDCAD

With the above reasoning, we recommend stay firm with longs that was advocated a week ago in order to arrest potential downside risks of this pair in medium run . Hence, longs on 1M 2 lots of At-The-Money -0.48 delta puts have begun functioning. We set up this strategy contemplating above delta risk reversal indications. The short ITM puts funds to the purchase of the greater number of long puts and the position is entered for no cost or a net credit.

Rationale: From the table showing delta risk reversal and above technical indications, the real challenge depends on a smart interpretation of these numbers and scrutiny of trend. The delta risk reversals of 1W to 1M contracts have now shifted into negative and we've observed the impact of this computation last week on price rallies, now what do you think can happen..? The mystified picture has been uncovered in our above analysis and recommendation.

FxWirePro: Shorts on USD/CAD PRBS derive certain yields – shooting star signifies longs function

Friday, September 25, 2015 1:36 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: GBP/NZD down trend loses steam, remains on bearish path

FxWirePro: GBP/NZD down trend loses steam, remains on bearish path  Bitcoin’s Institutional Tug-of-War: Geopolitical Tensions Clash with USD 920 Million ETF Surge

Bitcoin’s Institutional Tug-of-War: Geopolitical Tensions Clash with USD 920 Million ETF Surge  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro- Major European Indices

FxWirePro- Major European Indices  Aussie Charge: AUDJPY Surges 100 Pips as Bulls Eye 112.00 Milestone

Aussie Charge: AUDJPY Surges 100 Pips as Bulls Eye 112.00 Milestone  FxWirePro: USD/JPY edges up, remains on front foot

FxWirePro: USD/JPY edges up, remains on front foot  FxWirePro: EUR/AUD recovers slightly but bearish outlook persists

FxWirePro: EUR/AUD recovers slightly but bearish outlook persists  FxWirePro: USD/CAD dips as Canadian dollar gains on oil surge and soft U.S. payrolls

FxWirePro: USD/CAD dips as Canadian dollar gains on oil surge and soft U.S. payrolls  FxWirePro: USD/ZAR rebounds strongly, upside pressure builds

FxWirePro: USD/ZAR rebounds strongly, upside pressure builds  FxWirePro: EUR/AUD drifts lower, could be on verge of bigger drop

FxWirePro: EUR/AUD drifts lower, could be on verge of bigger drop  FxWirePro: GBP/NZD topside capped, sellers still hold the advantage

FxWirePro: GBP/NZD topside capped, sellers still hold the advantage  FxWirePro: GBP/AUD momentum strongly bearish despite pause in losses

FxWirePro: GBP/AUD momentum strongly bearish despite pause in losses  NZDJPY Range Breakout Watch: Bulls Target 94.00 as Technical Consolidation Tightens

NZDJPY Range Breakout Watch: Bulls Target 94.00 as Technical Consolidation Tightens  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro: EUR/ NZD trends higher, but faces potential pitfalls

FxWirePro: EUR/ NZD trends higher, but faces potential pitfalls