The major currency counterparts of the dollar have begun the trading week with huge gains capitalizing on the last week’s disappointing US CPI as well as the rise in unemployment claims, as the dollar index currently trades at the 93.65.

Bears in dollar lined up to hit 3 weeks lows at 93.42 levels but the euro has given up its previous gains.

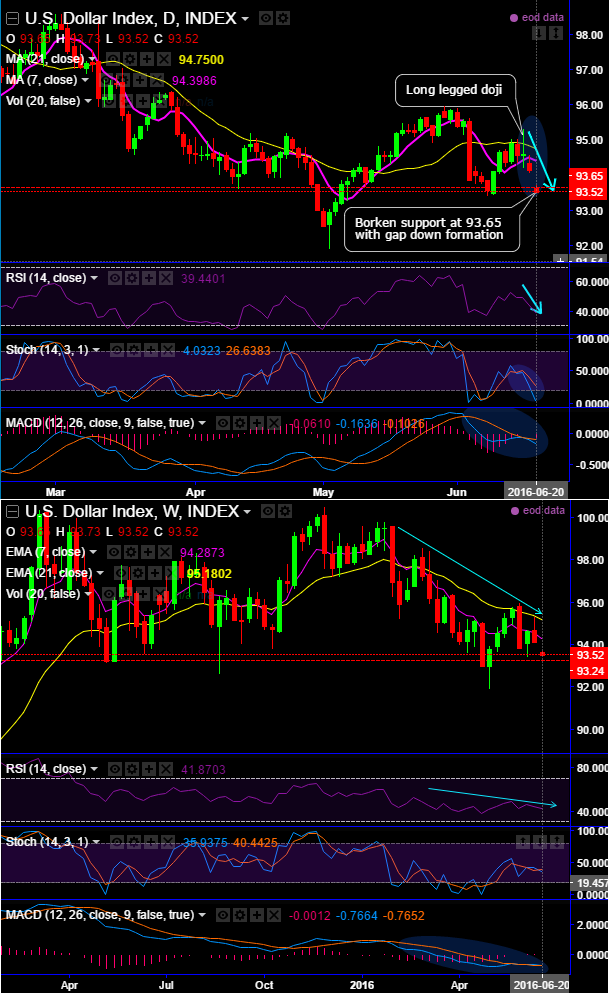

This has signaled a weakness in the index with a long legged doji occurred at 94.61 levels, as result prices have slid below DMAs.

The current prices have broken below the supports at 93.65 with a gap down formation.

It is currently hanging around the same support levels again at 93.65 with leading oscillators to converge the price dips.

If it doesn't manage to hold onto this level, then the next strong support can be seen at 93.24 levels on weekly charts, while leading oscillators converge downward to these price dips.

Even if it holds the current levels, we see restricted upside potential 7EMA levels, at this juncture momentum in previous rallies likely to collapse, long term downtrend seems intact.

RSI (14) on weekly and daily chart converging to the sideway trend and being bearish bias (Currently, daily RSI trending below at 40 while articulating). This technical indication has started evaluating the momentum ever since the formation of long legged doji at 93.61 levels by taking the computation of last 14 day periods the magnitude of recent gains to recent losses in an attempt to signify the overbought pressures.

While %D crossover has been maintained on the slow stochastic curve with every price dips again both on daily and weekly charts (Currently, %D line at 23.6383 while articulating).

As a result, in a long run we still project below or around 94 for Q3 end-2016, hence, it is good to go short in mid-month futures of DXY for above-mentioned targets.