The most important risk event for the GBP this week is the 18th - 19th February EU summit. We expect a correction lower in EURGBP in case an agreement is reached at the meeting, although an impasse and further GBP weakness is a non-negligible possibility.

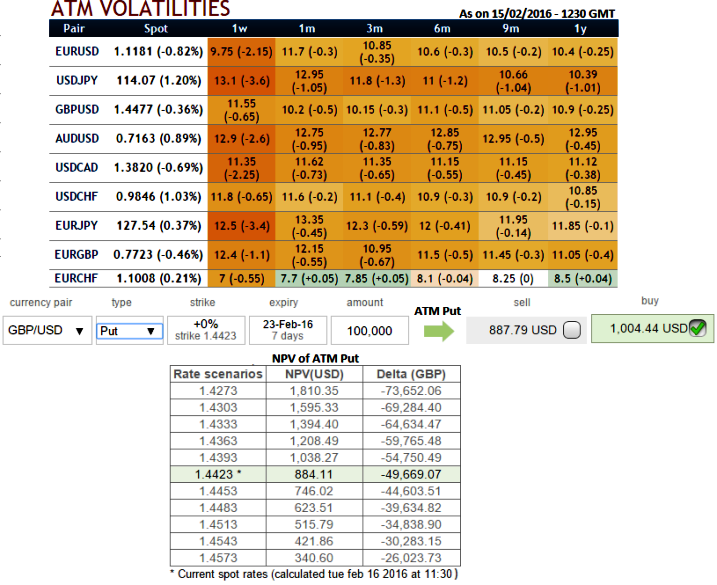

As a result, we saw rising OTC market sentiments for downside hedging activities, please be noted that the contemplating prevailing bearish trend of GBPUSD and risk reversal numbers accordingly, ATM puts have been fairly priced in (see diagram for correlated linear movements between option premiums, IVs and net present value. We see no much disparity between these computations. Thus, we can very well rely upon ATM instruments in backspreads so as to maximize the profitability.

The GBP will likely be supported by an expected uptick in today's CPI numbers. It is forecasted for January headline CPI to print at 0.3% YoY, as the major driving forces from crude oil prices and food price wars fall out, while core CPI is expected to remain unchanged at 1.4% y/y.

Moreover, we look ahead for a solid employment report (Wednesday). We expect December 2015 average weekly earnings growth to accelerate (to 2.4%) majorly due to bonus pay, while December core wage growth is likely to remain unchanged (at 1.9%), although we acknowledge downside risks. We expect the December ILO unemployment rate to dip 0.1 pp to 5.0%, in line with consensus.

Finally, we expect total retail sales (Friday) to accelerate at 1.3% MoM versus street's forecasts at 0.8% MoM after a significant downside surprise in December. We acknowledge risks to the upside in light of the strong spending signal from our Barclaycard Spend Trend Index as well as Visa's Expenditure Index.

As stated above, since we have fairly priced ATM puts with negative risk reversals for next 1M expiries, it is better to hedge downside risks of GBPUSD with put ratio back spreads using ATM instruments which would likely to expire in the money sooner considering above factors.

Hence, the recommendation would be going long in 2W at the money -0.49 delta put option and 1M (1.5%) out of the money -0.30 delta put and simultaneously short 1W (1%) in the money put with positive theta for net debit.

FxWirePro: Sterling's hedging sentiments mounting ahead of EU summit, data season - Use ATM in back spreads as no disparity between IVs and NPV

Tuesday, February 16, 2016 7:35 AM UTC

Editor's Picks

- Market Data

Most Popular