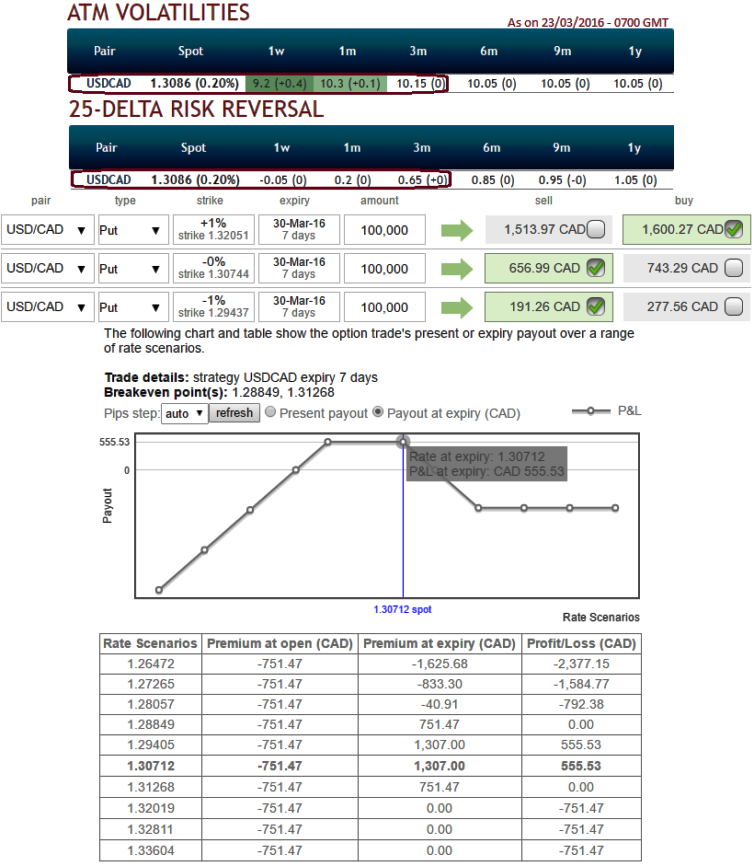

The implied volatility of USDCAD has been bullish neutral for 3M expiries among G7 currency segment contemplating risk reversal signals.

At spot ref: 1.3074, go long in 2M USD/CAD put ladder (strikes 1.3205/1.3074/1.2943).

Indicative offer: reduces cost about little more than 50% vs prem for ITM strike only.

The long put ladder is a limited returns and unlimited risk strategy as it proportionately employs more shorts in the spread because the underlying FX pair will experience little volatility in the near term (refer IV and risk reversal table).

Ideally, to execute this strategy, the options trader purchases an (1%) in-the-money delta put, short an at-the-money put and short another (1%) out-of-the-money put of the same expiration date.

Our put ladder is built as a standard put spread with tight strikes set at 1.3205/1.3074 financed by an OTM put with a strike at 1.2943.

Leaving only 125-130 pips between the former two strikes allows the profile to quickly reach the maximal possible leverage.

Unlike an usual put spread ratio, the maximal return is not reached on a given strike but over a wide region. It maximises the profitability of the trade via increased odds that the spot will trade in this region.

This short vega strategy is also short gamma so that an early spot depreciation will hurt the mark-to-market of the position.

Optimal leverage is only hit at the expiry and premature unwind is unlikely to be attractive before the two-thirds of the trade life.