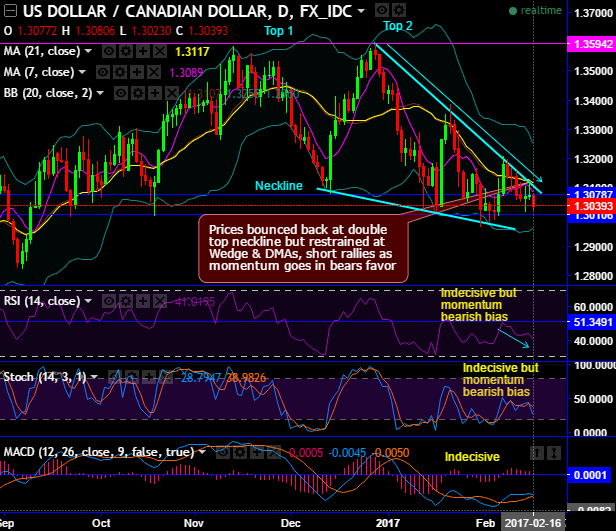

The prices have been consistently rejecting below falling wedge resistance from the last couple of days. Amid this price behavior, shooting star has occurred at 1.3078 levels.

The bearish rout has gone below strong support zone of 1.3078 levels (neckline of double occurred a few weeks ago).

As a result, the prices have gone below DMAs with bearish momentum remains intact.

Next immediate support is at 1.3010 levels, while MACD appears to be indecisive remaining below zero level which is bearish trajectory.

For now, the prices bounced back at the double top neckline but restrained at wedge top and DMAs, short rallies as bullish momentum is not convincing.

In the broader perspectives, Shooting star pattern have shown their bearish effects on monthly patterns (see monthly charts).

After spinning top & Doji patterns occurred during handle formation, upswings seem to be exhausted (refer monthly charts).

Momentum is turning away into bears’ favor and both leading indicators converge to the price dips.

MACD’s bearish crossover is also in conformity to the downtrend.

On daily terms, both leading oscillators signal selling interests, as RSI (14) evidences a bearish convergence with the declining prices below 51 levels.

Trade tips:

Well, contemplating above technical reasoning, on speculative grounds we advise tunnel spreads which are binary versions of the debit put spreads favoring bearish indications.

This strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at 1.3075 and lower strikes at 1.3010 levels.