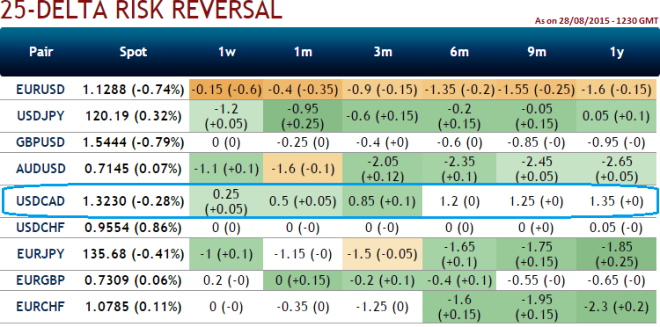

Since delta risk reversal of this pair divulges expensive hedging upside risks, as per the delta risk reversal computation in the money calls are overpriced premiums. In order to reduce the hedging costs, and those who expect the USDCAD to make a large move higher, then this strategy can be established as follows.

Purchase more number of out of the money +0.5 delta calls and sell in the money calls with a shorter expiry usually in a ratio of 2:1. The delta value remains high on the upside of underlying value as more and more upside price movements of the underlying makes the option position more sensitive to the relative change in USDCAD exchange rate.

So the lower strike short calls finances the purchase of the greater number of long calls and the position is entered for no cost or a net credit. The dollar has to make substantial move on the upside for the gains in long calls to overcome the losses in the short calls as the maximum loss is at the long strike.

FxWirePro: USD/CAD delta risk reversal signifies upside hedging – prefer CRBS

Friday, August 28, 2015 1:55 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: USD/CAD dips as Canadian dollar gains on oil surge and soft U.S. payrolls

FxWirePro: USD/CAD dips as Canadian dollar gains on oil surge and soft U.S. payrolls  ETH Pulls Back to $ 2,020 After $ 2,200 Spike – Buy-the-Dip Setup Emerging?

ETH Pulls Back to $ 2,020 After $ 2,200 Spike – Buy-the-Dip Setup Emerging?  FxWirePro: EUR/AUD drifts lower, could be on verge of bigger drop

FxWirePro: EUR/AUD drifts lower, could be on verge of bigger drop  Pound-Yen Steady: GBPJPY Bulls Gather Strength for a 212.00 Push

Pound-Yen Steady: GBPJPY Bulls Gather Strength for a 212.00 Push  FxWirePro- Major European Indices

FxWirePro- Major European Indices  FxWirePro- Major European Indices

FxWirePro- Major European Indices  NZDJPY Range Breakout Watch: Bulls Target 94.00 as Technical Consolidation Tightens

NZDJPY Range Breakout Watch: Bulls Target 94.00 as Technical Consolidation Tightens  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: EUR/ NZD stuck in range but maintains bearish bias

FxWirePro: EUR/ NZD stuck in range but maintains bearish bias  FxWirePro: USD/JPY edges up, remains on front foot

FxWirePro: USD/JPY edges up, remains on front foot  FxWirePro: GBP/NZD topside capped, sellers still hold the advantage

FxWirePro: GBP/NZD topside capped, sellers still hold the advantage  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro: USD/ZAR rebounds strongly, upside pressure builds

FxWirePro: USD/ZAR rebounds strongly, upside pressure builds  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: GBP/AUD recovers slightly but bias is still bearish

FxWirePro: GBP/AUD recovers slightly but bias is still bearish  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)