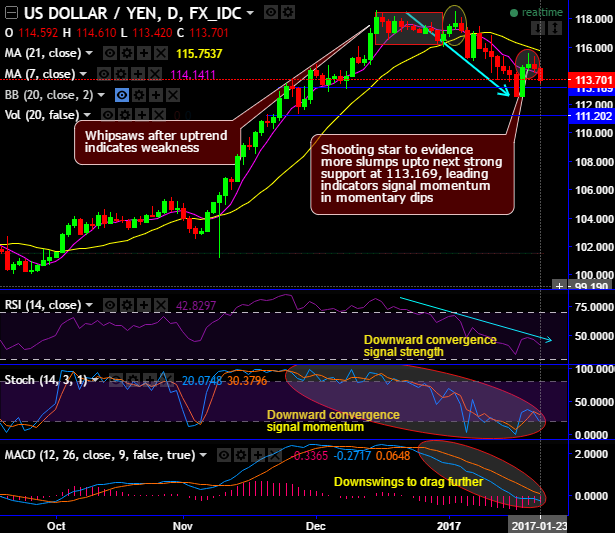

You could observe USDJPY bears extend Friday’s price drops after shooting star placed at 114.863 levels (Refer daily charts).

To begin 2017 USDJPY dropped vigorously from the highs of 118.608 levels to the current 113.610 levels, the flurry of bearish streaks occurred especially after Whipsaws in the uptrend that indicates weakness on Fed’s minutes that includes gradual hiking hints.

The current prices have dipped well above DMAs on daily charts, for now, don't expect the sharp rallies nor a steep slump as it is likely to test support at 113.169 levels, and it is better to go short upon breach below these levels that favors bears.

On weekly terms, long legged doji has been formed at 116.942 levels, consequently, the price dips have gone below 7SMAs.

RSI signals the strength in selling interests as it converges to the consistent downswings, while Stochastic has been indecisive but momentum in selling sentiments has been absolutely in bears favour.

Same is the case with leading oscillators on weekly terms to confirm the intensified selling momentum as both RSI and stochastic have been converging to the prevailing price downswings.

While daily MACD has signaled the downtrend likely to extend.

Trading tips:

Well, as a result of above technical reasoning, on speculative grounds we advise tunnel spreads which are binary versions of the debit put spreads.

This strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at 114.592 and lower strikes at 112.958 levels.

Alternatively, we advocate shorting futures contract of near-month expiries on hedging grounds that safeguards FX exposures from the potential risks of plummeting up to 111.416 levels.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.