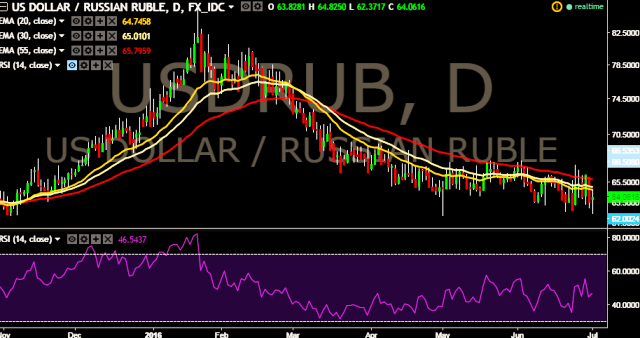

- USD/RUB is currently trading around 64.02 levels.

- It made intraday high at 64.82 and low at 62.37 levels.

- Intraday bias remains bearish till the time pair holds key resistance at 65.33 marks.

- Pair is moving well in range bound directions. A break of either side (62.37 – 66.27) will only provide the short term trend for the parity.

- A daily close below 63.00 mark will tests key supports at 62.21 and 60.98 marks respectively.

- On the top side, key resistances are seen at 64.71, 65.72, 66.06 and 67.00 levels respectively.

- Important to note here that, 20D, 30D and 55D EMA heads down and confirms bearish trend.

Positioning is inconclusive at this point, with prices offering no clear cut signal to initiate a long or short trade. We will continue to remain on sidelines for the time being.