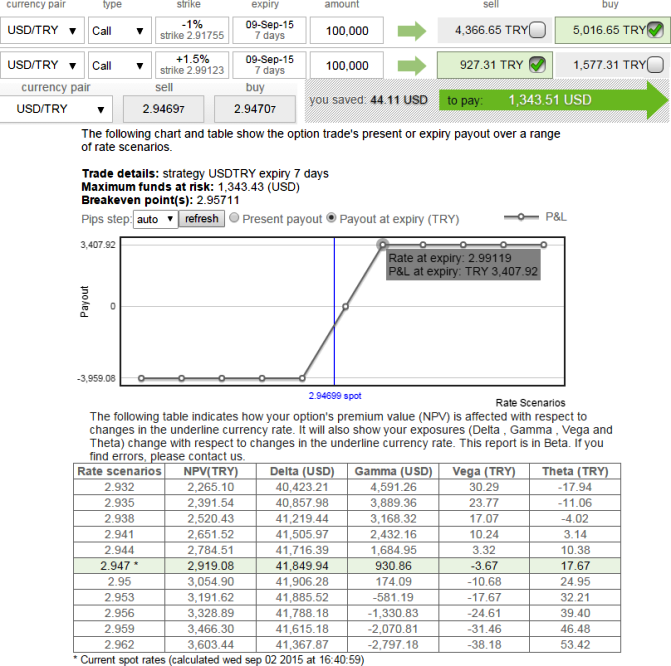

With swing trading mindset, we are recommending to buy 1M 1% in the money 0.68 delta calls and simultaneously short 7D 1.5% out of the money call, the combined delta value should be around 0.45. We've shown in the diagram as to how the strategy can be built in. However, for the demonstration purpose expiries have been identical.

Why this call spread: As explained in our recent post, a short term correction is expected on this pair and because of this expectation, with a view of swing trading an OTM call shorting is advised. An investor often employs the bull call spread in moderately bullish market environments, and wants to capitalize on a modest advance in price of the underlying asset. If the investor's opinion is very bullish on USDTRY, it will generally prove more profitable to make a simple call purchase.

Risk Reduction: An investor will also turn to this spread when there is discomfort with either the cost of purchasing and holding the long call alone, or with the conviction of his bullish market opinion.

Risk/Reward Profile: Maximum loss for this spread will generally occur as the USDTRY declines below the lower strike price (i.e. 2.9141). If both options expire out of the money with no value, the entire net debit paid for the spread will be lost. The reward is that the bull call spread tends to be profitable when the USDTRY increases in price. It can be established in one transaction, but always at a debit (net cash outflow). The call with the lower strike price will always be purchased at a price greater than the offsetting premium received from writing the call with the higher strike price.

FxWirePro: USD/TRY debit call spread on minor corrections of healthy uptrend

Wednesday, September 2, 2015 12:15 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: AUD/USD firms as demand for the U.S. dollar eases

FxWirePro: AUD/USD firms as demand for the U.S. dollar eases  FxWirePro: EUR/AUD drifts lower, could be on verge of bigger drop

FxWirePro: EUR/AUD drifts lower, could be on verge of bigger drop  FxWirePro: EUR/ NZD stuck in range but maintains bearish bias

FxWirePro: EUR/ NZD stuck in range but maintains bearish bias  FxWirePro: USD/ZAR rebounds strongly, upside pressure builds

FxWirePro: USD/ZAR rebounds strongly, upside pressure builds  FxWirePro: USD/ZAR uptrend loses steam, remains on bullish path

FxWirePro: USD/ZAR uptrend loses steam, remains on bullish path  FxWirePro: EUR/AUD recovers slightly but bearish outlook persists

FxWirePro: EUR/AUD recovers slightly but bearish outlook persists  FxWirePro- Major European Indices

FxWirePro- Major European Indices  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  Pound-Yen Steady: GBPJPY Bulls Gather Strength for a 212.00 Push

Pound-Yen Steady: GBPJPY Bulls Gather Strength for a 212.00 Push  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro: GBP/NZD down trend loses steam, remains on bearish path

FxWirePro: GBP/NZD down trend loses steam, remains on bearish path  NZDJPY Range Breakout Watch: Bulls Target 94.00 as Technical Consolidation Tightens

NZDJPY Range Breakout Watch: Bulls Target 94.00 as Technical Consolidation Tightens  Ethereum Trade Alert: Accumulating at Support as Risk-On Sentiment Returns

Ethereum Trade Alert: Accumulating at Support as Risk-On Sentiment Returns  FxWirePro: EUR/ NZD trends higher, but faces potential pitfalls

FxWirePro: EUR/ NZD trends higher, but faces potential pitfalls  Institutional Fever: Is Bitcoin Gearing Up for a Historic 80,000 USD Run?

Institutional Fever: Is Bitcoin Gearing Up for a Historic 80,000 USD Run?  FxWirePro: USD/JPY edges up, remains on front foot

FxWirePro: USD/JPY edges up, remains on front foot