We had advised bull call spreads on 02nd and this has been three days in arrow that the pair is gaining. So thereby our ITM calls on below strategy is working pretty well and now it's the time for OTM calls which has begun its functioning as the pair has dropped from 3.0314 levels to 3.0082 levels.

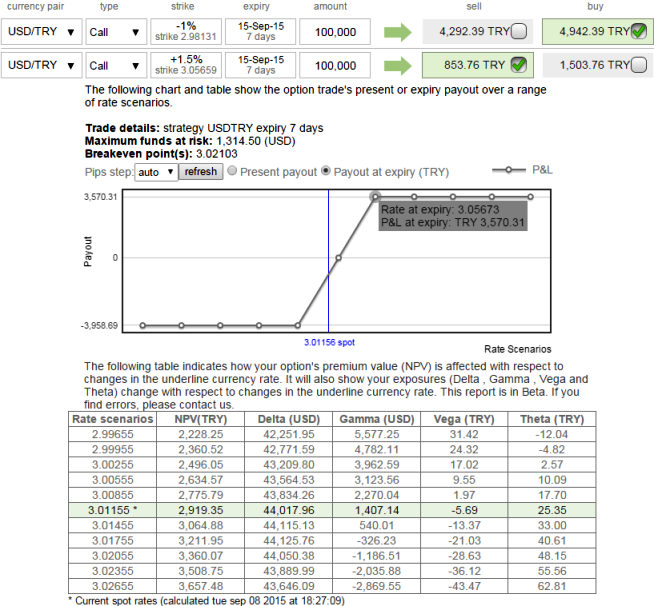

So with swing trading mindset, we still recommend buying 1M 1% in the money 0.66 delta calls and simultaneously short 7D 1.5% out of the money call, the combined delta value should be around 0.44. We've shown in the diagram as to how the strategy can be built in. However, for the demonstration purpose expiries have been identical.

Why call spread: As explained in our recent post, a short term correction is expected on this pair and because of this expectation, with a view of swing trading an OTM call shorting is advised. An investor often employs the bull call spread in moderately bullish market environments, and wants to capitalize on a modest advance in price of the underlying asset. If the investor's opinion is very bullish on USDTRY, it will generally prove more profitable to make a simple call purchase.

Risk Reduction: An investor will also turn to this spread when there is discomfort with either the cost of purchasing and holding the long call alone, or with the conviction of his bullish market opinion.

FxWirePro: USD/TRY longs of debit call spreads on job, shorts began functioning

Tuesday, September 8, 2015 1:01 PM UTC

Editor's Picks

- Market Data

Most Popular

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  AI is already creeping into election campaigns. NZ’s rules aren’t ready

AI is already creeping into election campaigns. NZ’s rules aren’t ready  The strikes on Iran show why quitting oil is more important than ever

The strikes on Iran show why quitting oil is more important than ever