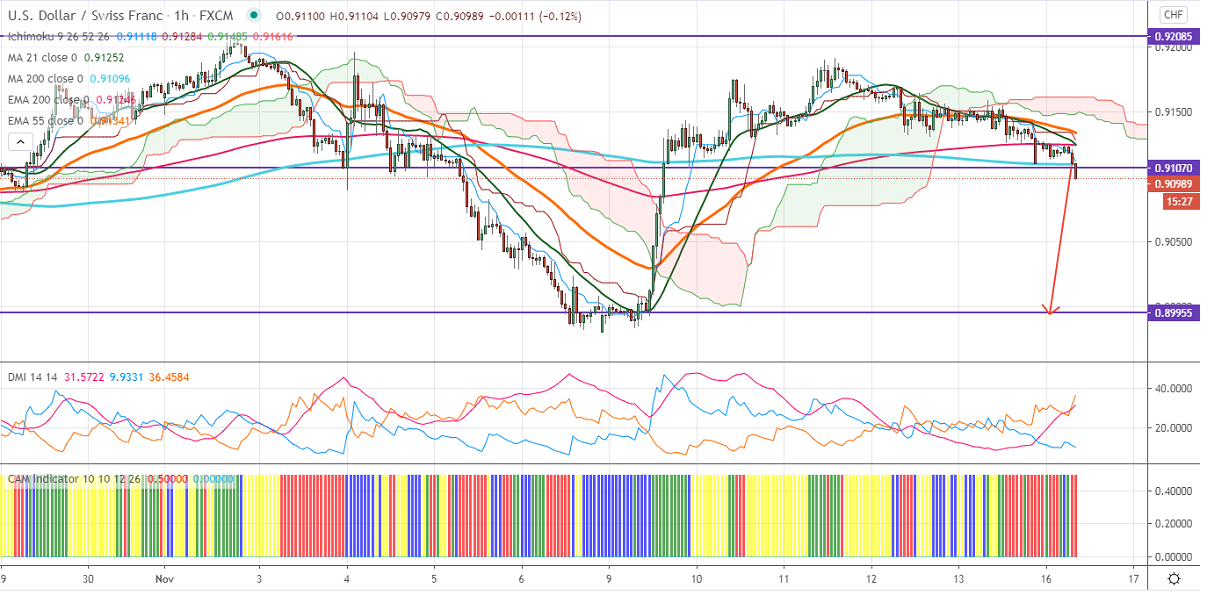

Ichimoku Analysis (Hourly chart)

Tenken-Sen- 0.91178

Kijun-Sen- 0.91338

USDCHF has formed a temporary top around 0.9200 and shown a minor dip. The demand for riskier assets increased due to the COVID-19 vaccine optimism and ASEAN trade deal. DXY continues to trade weak. The index broke significant support 92.50, a dip till 92 likely. US bond yield lost more than 10% after hitting a multi-month high at 0.982%. USD CHF hits an intraday low of 0.90983 and is currently trading around 0.90980.

On the lower side, the pair is trading below 200 H MA and any break below will drag down till 0.9050/0.900. The near –term resistance is around 0.9165, an indicative break above targets 0.9200/0.9245.Significant buying only above 0.93000.

It is good to sell on rallies around 0.91180-20 with SL around 0.9165 for the TP of 0.9000.