Ichimoku analysis (Hourly chart)

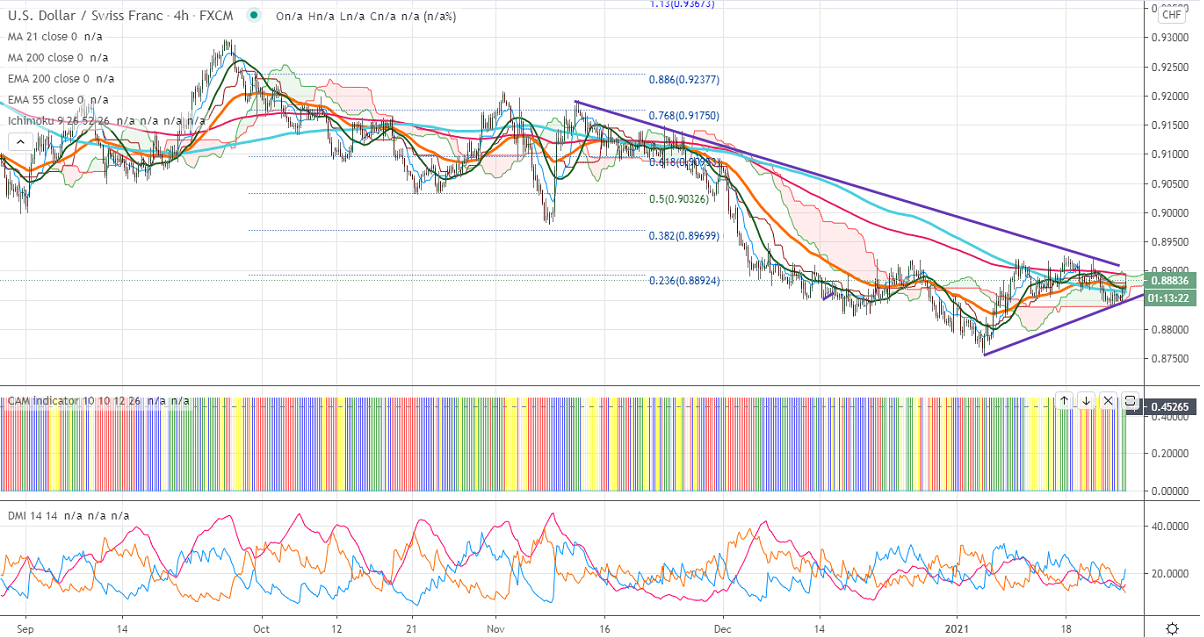

Tenken-Sen- 0.88576

Kijun-Sen- 0.88795

USDCHF's intraday trend is bullish as long as support 0.8840 holds. Any violation above 0.8925 confirms short term bottoming at 0.8756. The surge in coronavirus cases and risk aversion back US dollar. DXY has once again recovered from a low of 90. Any significant weakness only below 90 levels.

The near term resistance at 0.8925; any convincing violation above will take to the next level till 0.89398 (55- day EMA)/0.8965/0.9000.

On the lower side, significant support stands at 0.8820, any indicative break below targets 0.8800/0.8750.

It is good to buy above 0.8920 with SL around 0.8870 for a TP of 0.9000.