GBP fell further than expected in the aftermath of the UK vote to leave the EU and after the MPC eased policy at the start of August.

Since then, a bounce in economic indicators has been accompanied by a GBP bounce to levels where fresh shorts, vs EUR, are attractive.

The UK produces upbeat numbers:

Service PMIs – actual 52.9 versus previous 47.4 and forecasts were at 49.1;

Construction PMIs – actual 49.2 versus previous 45.9 and forecasts were at 46.6;

Manufacturing PMIs – actual 53.3 versus previous 48.3 and forecasts were at 49.1.

Despite these indications, the UK economy was slowing before the referendum and the additional uncertainty from the vote will only exacerbate that downtrend. On the other hand, BOE stays pat in its monetary policy hinting on the further easing cycle in upcoming meetings.

The initial weakness of (mostly) survey data pointed to an economic hit but overstated the near-term magnitude. The better recent data confirms the sky didn't fall, but a long period of corrosive economic uncertainty still lies ahead.

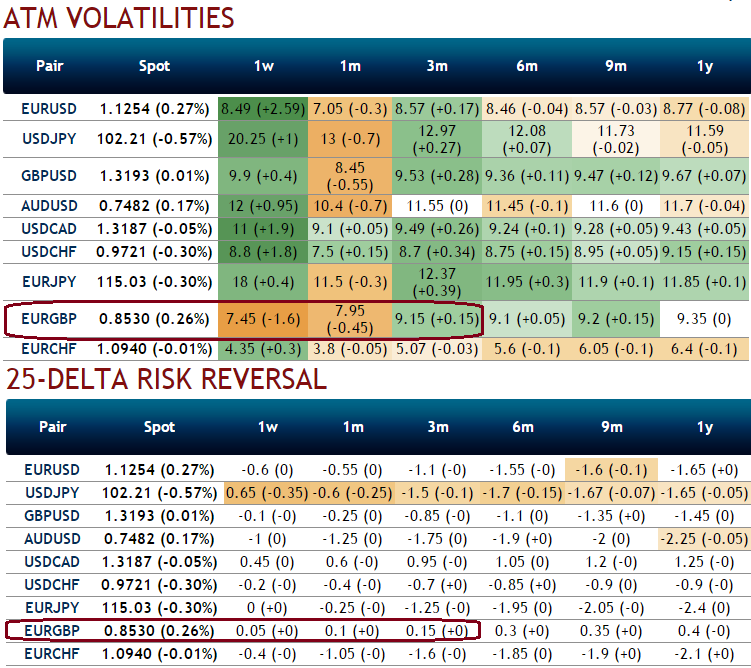

As shown in the above nutshell, 3m IVs and risk reversals seem comparatively attractive bid over 1m tenors. 1w IVs are collapsed below 7.5%, and risk reversal indicates no significant upside risk in this period, as a result, we ponder over shorting an ITM call option while holding long term calls to hedge upside risks.

Hence, we recommend initiating longs in 2 lots of 1M ATM +0.51 delta call, and simultaneously short 1 lot of ITM call (1%) 1w expiry in the ratio of 2:1.

So, trading option spreads in different strikes allows the traders in many tricky market scenarios and likely to fetch positive cash flows.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics