RBA’s monetary policy meeting is scheduled on May 2nd; April’s central bank's board meeting minutes has been more dovish than previous months’.

1Q CPI next week’s focus; we forecast headline at 0.6% q/q and core at 0.4% q/q.

Terms of trade and private credit also important releases in the week ahead.

Kiwi CPI firmer than expected at 1%q/q, led by tradable inflation.

AUDNZD higher towards 1.0900 multi-day, global risk-aversion fading (AUD is more sensitive).

The medium term perspectives: Higher to 1.10. The cross remains well below fair value estimates implied by interest rates, commodity prices, and risk sentiment, although is closing the gap (6 Mar).

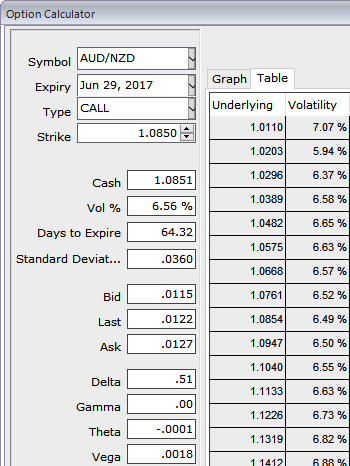

Please be noted that the IVs 2m ATM contracts have been tepid, creeping up at 6.56% which is on the lower side. An option writer wants lower IVs or IVs to fade away in an anticipation of premium to shrink away. You should also note short-dated options are less sensitive to IV, while long-dated is more sensitive.

Hence, amid lower IV environment, we advocate below option strategy:

Buying a 2-month AUDNZD 1.09-1.11-1.13 (1x2x1) call fly spread would likely keep underlying price fluctuation on the check.

BEP at 1.0848 and returns are likely when underlying spot FX keeps flying above these levels.

Long butterfly spreads are entered when the investor thinks that the underlying spot FX would not spike nor drop dramatically by expiration. Deploying calls, the long butterfly can be constructed by buying one lower striking ITM call, writing two ATM calls and buying another higher striking OTM call. A resulting net debit is taken to enter the trade.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different