Evidently, yesterday's OPEC production cut agreement was much more important for the global oil complex. You could probably understand this while viewing crude prices.

However, for those following the routine fundamental data flow, this week's US stats were bullish for crude and bearish for refined products.

Crude stocks drew against expectations, as imports remained relatively low following the previous week's large drop. The draw came despite a drop in refinery runs, which in preceding weeks had been rising seasonally.

Turning to refined products, distillate and gasoline saw larger-than-expected builds, with domestic fuel production continuing to climb in the wake of refinery maintenance season. Total US 4w av. product demand grew by 191 kb/d to 19.83 Mb/d (+1.0% y-o-y).

As we expect crude price consolidation phase likely to extend further, the forecasts for Q1’2016 would be around $55-$60, while the sustenance above $50 seems to be most likely for now.

Trade with safe & limited yields and limited risk:

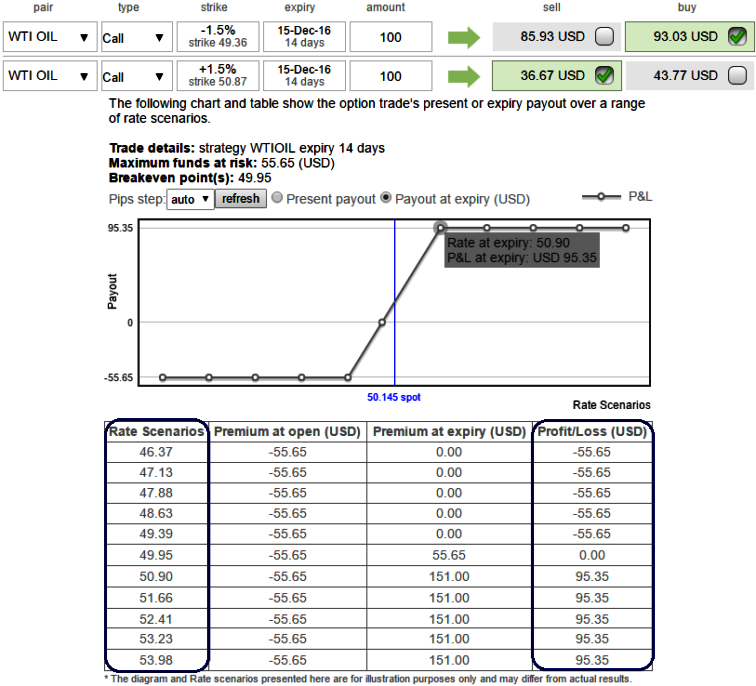

Pondering over the both fundamental developments as well as the technical trend, as shown in the diagram we recommend initiating long in 2w (1%) ITM +0.67 delta call, and simultaneously short 2W (1.5%) OTM call with preferably positive theta or closer zero, the strategy could be executed at net delta of 25%.

Margin: Yes, needed on the short leg.

Rationale: Capitalising on bullish sentiments backed by the reliable fundamental news as stated above but upside potential capped at around 54-55 levels.

The Delta is continuously varying as the underlying spot FX fluctuates. Long options with further in-the-money (ITM) would have a higher Delta. This indicates that ITM options are worth more per pip movement in the underlying market and out-the-money options are worth less per pip.

Strategy run-through:

One can use this strategy upon the expectation of speculative grounds that the underlying WTI crude spot would rise but certainly not with drastic pace.

The strategy could derive the positive cashflows as long as spot WTI crude price trades above $50 mark, and even if it goes against, the maximum loss is limited by OTM strike price, having shorts in this strategy capitalize on reducing vols and initial premiums that we receive would finance for the long position.

Risk/Reward Profile: The profit is limited by OTM strike price, No matter how far the market moves above, the profit remains the same.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty