The recent OPEC’s agreement to cut output by 1.2 Mb/d from January next year together with the possibility of non-OPEC cuts of some 600 kb/d should result in meaningful global oil stock draws next year (even if full compliance is unlikely).

Therefore, we foresee the scope for WTI to approach $60 by end-17. Annual global oil demand growth is forecast at a healthy 1.25 Mb/d in 2016 and 1.26 Mb/d in 2017, driven by emerging markets, especially China, India, and other non-OECD Asia.

WTI has averaged in the $45-50 range since Q2’16 and due to the persistent contango on the forward curve (front-month vs one-year forward time spreads have consistently been in the $3-6 range), producers have been able to lock in higher prices through hedging (selling forward). The prospect of a gradual recovery in US shale production next year is likely to slow the uptrend in oil prices.

The implied volatilities of crude oil options have dropped sharply on the back of last week’s OPEC deal. For example, the 3m at-the-money WTI implied volatility has dropped a massive 10 percentage points to about 33% since the OPEC announcement to cut output by 1.2 Mb/d.

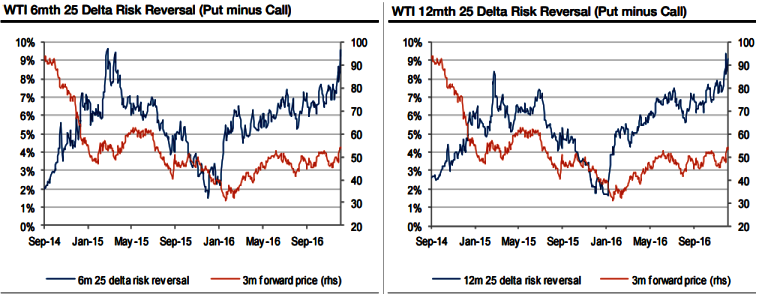

As we have mentioned before, we believe that the return of OPEC to active supply management is like to result in 3m implied crude vols trading below 30% to around 25% over time. Notably, you could also observe risk reversal curve is clearly followed by crude forwards curve.

The charts below should make it easy to decide whether to use a simple vanilla long call (put) option strategy or a long call spread (put spread) in order to benefit from a given 3m view on the underlying forward price.

As stated above, $60 is clearly forecasted and the yields are very much achievable vai call spreads, the right side charts, demonstrates 1x1.5 option spreads based on the optimized strikes from the 1x1 option spreads.

The 1x1.5 option spreads would be net profitable at expiry if the forward price moves by a % between the blue and light gray lines but increasingly loss-making beyond the gray line.

The brown line represents maximum profit at expiry which would be considerable higher than a gross profit of 4 times the premium paid.

Optimised 1x1 call and put options are shown in the left side chart: the blue line represents the long strike, measured as a % away from the forward price; and the brown line represents both the short strike and the smallest possible move in the forward price that would generate a gross profit of 4 times premium paid at expiry.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts