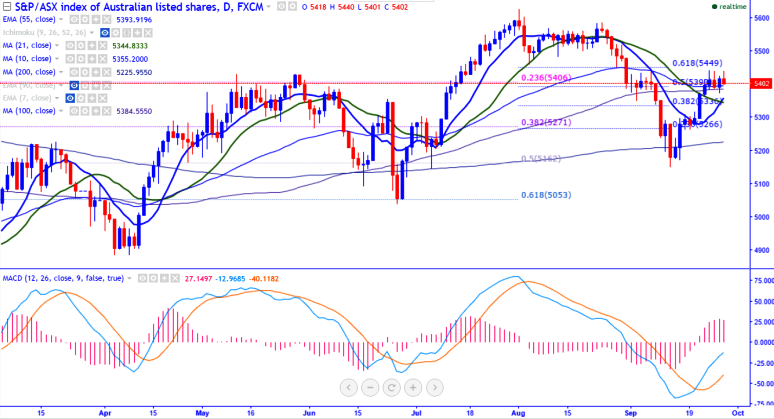

- Major resistance- 5449 (61.8% retracement of 5625 and 6152).

- Major support -5350 (21- day MA).

- The index has formed double top around 5440 and slightly fell from that level. It is currently trading around 5392.

- ASX200 is trading slightly above Tenken-Sen (5368) and Kijun-Sen (5284) in the hourly chart.

- On the higher side,any break above 5449 (61.8% retracement of 5625 and 6152) confirms minor trend reversal, a jump till till 5449 (61.8% retracement of 5625 and 6152)/5500. The index should break above 5625 for further jump till 5700.

- The major support is around 5350 and any break below targets 5300/5285 in the short term.

It is good to sell on rallies around 5405-5410 with SL around 5450 for the TP of 5360/5300