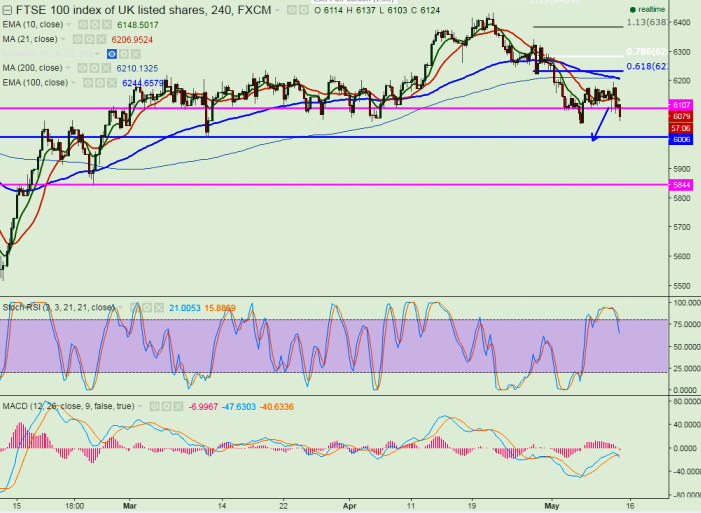

- Major support - 6100

- FTSE100 has declined after making a high of 6196 yesterday. It is currently trading around 6086

- Short term trend is slightly weak as long as resistance 6210 holds. Minor bullishness can happen only if it breaks above 6210 (200 day 4H MA).

- Any indicative break above 6210 will take the index to next level till 6235/6285/6300.

- Minor trend reversal only above 6350

- On the lower side any break below major support 6100 will drag the index down till 6000/5850.

It is good to sell on rallies around 6120-6130 with SL around 6210 for the TP of 6000/5860