USDCHF pair has been absolutely non-directional and puzzling from mid August, earlier to which the pair was moving well within the range. For short term traders it seems like uptrend remains intact as the RSI oscillator moves in convergence with price rallies, while slow stochastic curve approached 80 levels but no scenes of overbought pressures.

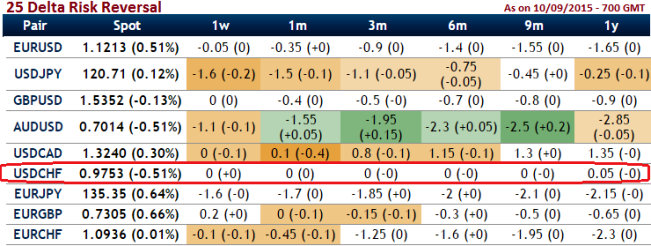

From the above nutshell showing delta risk reversal of G10 pairs we can identify both calls and puts have been fairly priced in according to the non-directional trend which we've already mentioned above. Although shorting an ATM call confines the upside potential of the hedge, a few risk averse or laggards thinks that it is more important to be hedged at minimal cost. To that end, one of the most popular risk reversals is the zero cost risk reversal where you don't have to pay a premium.

Why use a risk reversal: You would enter into a risk reversal if you want to hedge your underlying risk while lowering the cost of this premium. For an instance, you can buy a USD/CHF call to cover the risk of an increase in the value of the underlying asset. Simultaneously, you sell a USD/CHF put. Although the put limits any upside should the underlying actually fall in value, it also significantly reduces the cost of the overall strategy. Any existing shorts in underlying position, then you would buy a risk reversal (long on call and short on put) and Long underlying position you would sell a risk reversal (i.e. long on put and shorts on call).

Glimpse on USD/CHF delta risk reversal and minimal cost of hedging

Thursday, September 10, 2015 1:02 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro- Major European Indices

FxWirePro- Major European Indices  FxWirePro: USD/CAD dips as Canadian dollar gains on oil surge and soft U.S. payrolls

FxWirePro: USD/CAD dips as Canadian dollar gains on oil surge and soft U.S. payrolls  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Institutional Fever: Is Bitcoin Gearing Up for a Historic 80,000 USD Run?

Institutional Fever: Is Bitcoin Gearing Up for a Historic 80,000 USD Run?  FxWirePro- Major European Indices

FxWirePro- Major European Indices  FxWirePro: USD/ZAR uptrend loses steam, remains on bullish path

FxWirePro: USD/ZAR uptrend loses steam, remains on bullish path  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: EUR/AUD recovers slightly but bearish outlook persists

FxWirePro: EUR/AUD recovers slightly but bearish outlook persists  Pound-Yen Steady: GBPJPY Bulls Gather Strength for a 212.00 Push

Pound-Yen Steady: GBPJPY Bulls Gather Strength for a 212.00 Push  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  ETH Pulls Back to $ 2,020 After $ 2,200 Spike – Buy-the-Dip Setup Emerging?

ETH Pulls Back to $ 2,020 After $ 2,200 Spike – Buy-the-Dip Setup Emerging?  FxWirePro: GBP/AUD momentum strongly bearish despite pause in losses

FxWirePro: GBP/AUD momentum strongly bearish despite pause in losses  FxWirePro: EUR/ NZD stuck in range but maintains bearish bias

FxWirePro: EUR/ NZD stuck in range but maintains bearish bias  FxWirePro: AUD/USD firms as demand for the U.S. dollar eases

FxWirePro: AUD/USD firms as demand for the U.S. dollar eases  FxWirePro: GBP/USD downside pressure builds, key support level in focus

FxWirePro: GBP/USD downside pressure builds, key support level in focus