Gold prices hit a fresh all-time high on safe-haven demand. It hit an intraday high of $3819 and is currently trading around $3814.

Driven by growing worries of a US government shutdown scheduled for September 2025, gold prices have shot to all-time highs over $3,800 per ounce. Start on September 30, and increased uncertainty resulting from President Trump's broad tariff policy. The approaching shutdown threatens to interfere with important economic releases, including the essential September job report due on October 3, hence muddying the Federal Reserve's route for interest rate judgments. With markets pricing in a 90% probability of an October rate cut and 65% for December, analysts like Soojin Kim of MUFG emphasize how late data could magnify demands for relief, so stimulating demand for non-yielding safe-haven assets such as gold among continuing labor market issues.

Including an unanticipated 25% tax on Indian imports (raising some duties to 50%), reciprocal 39% taxes on market volatility have been further exacerbated by Trump's tariff increases. Swiss products upsetting bullion supply lines and an unusual inclusion of gold bars in tariff coverage have astounded investors and created questions about American goods. The viability of futures trading, as indicated by UBS strategist Joni Teves. Gold's year-to-date surge of more than 45% with an intraday high of $3,848.80 on September 28—its sixth straight weekly gain—driven by this policy-driven volatility—silver rose 2% to $46.96 per ounce. Furthering the gold run, a declining US Dollar Index at 97.94 has increased its attractiveness to worldwide investors, therefore indicating a larger flight from the currency and US debt as per Ipek Ozkardeskaya from Swissquote Bank.

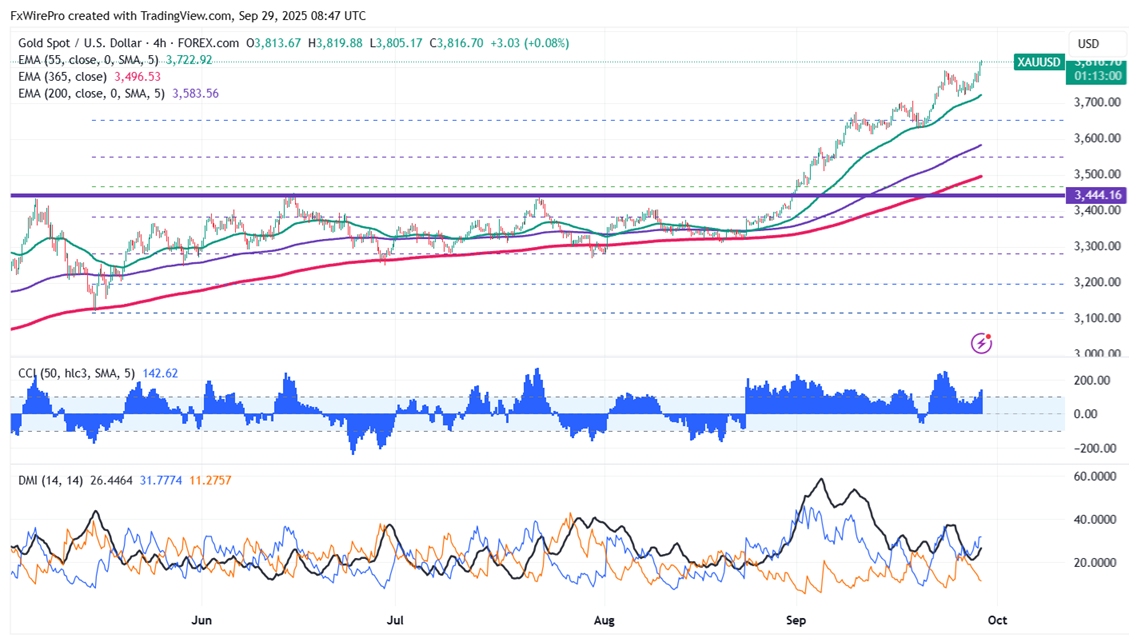

Technical Analysis: Key Levels and Trading Strategy

Gold prices are holding above the short-term moving average 34 EMA and 55 EMA) and the long-term moving averages (200 EMA) on the 4-hour chart. Immediate support is at $3760, and a break below this level will drag the yellow metal to $3700/$3675/$3653/$3600. The near-term resistance is at $3830 with potential price targets at $3850/$3900.

It is good to buy on dips around $3628-30 with a stop-loss at $3600 for a target price of $4000.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate