Inorder to increase inflows to India , the government has taken many steps in a major liberalisation of FDI regime. 15 sector's FDI regulations have been eased, limit on Foreign Investment Promotion Board(FIPB) is extended to INR50bn from INR30bn. These changes will lead to quicker FDI approvals, also by reducing paperwork.

Rules on FDI have also been diluted in wholesale and retail activities, defence sector, private banks and construction sector, helping improve job creation, boosting the sectors.

Capital account signals will be further opened up, which indicates government's willingness to undertake reforms, besides political setbacks recently.

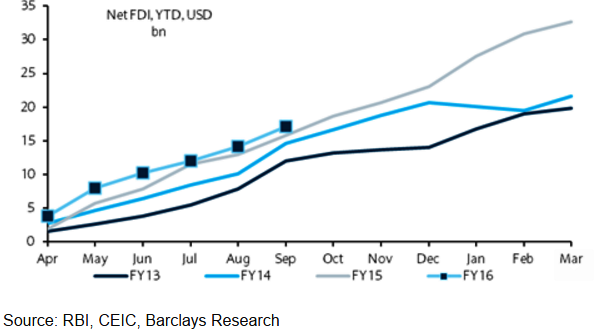

Government has been easing FDI regime since it took powers, USD17.1bn of net inflows are seen in first half of 2015, last year net FDI was USD 32 bn, following a series of liberalisation steps since September 2015, when Government in conjuction with Reserve Bank, announced opening of bond market to greater foreign paarticipation.

Indian government also started a bankruptcy draft code, with further fiscalisation of oil price profits by indirect taxes.

"The challenge remains in getting parliamentary approvals for key tax reforms such as the Goods & service tax, which requires two-thirds majority approval from both houses of parliament", says Barclays in a research note.

Indian government takes major FDI liberalization moves, key reform approvals remains a challenge

Wednesday, November 11, 2015 5:37 AM UTC

Editor's Picks

- Market Data

Most Popular

Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade

Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade  Gold Prices Rebound as U.S. Tariffs, Fed Policy and Iran Talks Drive Market Sentiment

Gold Prices Rebound as U.S. Tariffs, Fed Policy and Iran Talks Drive Market Sentiment  PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation

PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation  Oil Prices Steady as US-Iran Nuclear Talks and Rising Crude Inventories Shape Market Outlook

Oil Prices Steady as US-Iran Nuclear Talks and Rising Crude Inventories Shape Market Outlook  Asian Markets Slide as Nvidia Earnings, U.S.-Iran Tensions and AI Valuations Weigh on Investor Sentiment

Asian Markets Slide as Nvidia Earnings, U.S.-Iran Tensions and AI Valuations Weigh on Investor Sentiment  Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom

Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom  U.S.-Canada Trade Talks Resume as Trump Administration Reviews USMCA

U.S.-Canada Trade Talks Resume as Trump Administration Reviews USMCA  China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump

China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump  Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement

Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement