European Central Bank (ECB) has taken unprecedented steps to ease monetary policy through asset purchase for the first time in history to fight deflation. From 9th march 2015, it started to purchase securities worth € 60 billion per month.

- Latest information, suggested inflation expectation as measured by 5y5y swap rates, over five years increased after slumping in January.

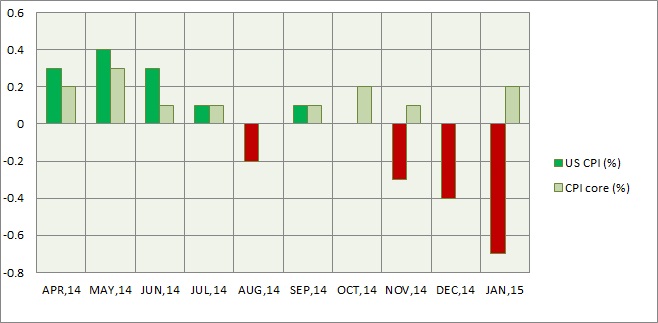

- Today, hard facts published showed signs of improvements and hints that monetary policy stands in right direction.

Hard facts -

- Germany - German economy remains robust, latest retails sales pointed at solid gain. Consumer price index increased 0.9% mom and 0.1% YoY. HICP inflation increased 1.1% from previous -1.3% mom.

- France - France remained much weaker through the crisis and yet to recover. GDP, manufacturing and services PMI, industrial production all pointing to continued slowdown. However CPI figure came back sharply in positive territory after dwindling over last year. CPI grew at 0.7% mom compared to previous -1.1%. CPI still fell by -0.3% YoY.

- Spain - Spain is Euro zone's top turn around child. Recent data points to solid comeback however inflation remained in negative territory. Today's data is positive but subdued. CPI increased by 0.2% mom however still down by -1.1% yearly basis.

Impact -

- Euro so far has taken the data on positive side covering some lost grounds. Euro is currently trading at 1.063, up 0.8% for the day.

- In spite of positive number, inflation remains subdued. Until significant jump is there, will not impact the monetary policy decisions.

- European stock might extend gains further, as they still remain cheaper and outlook improves.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate