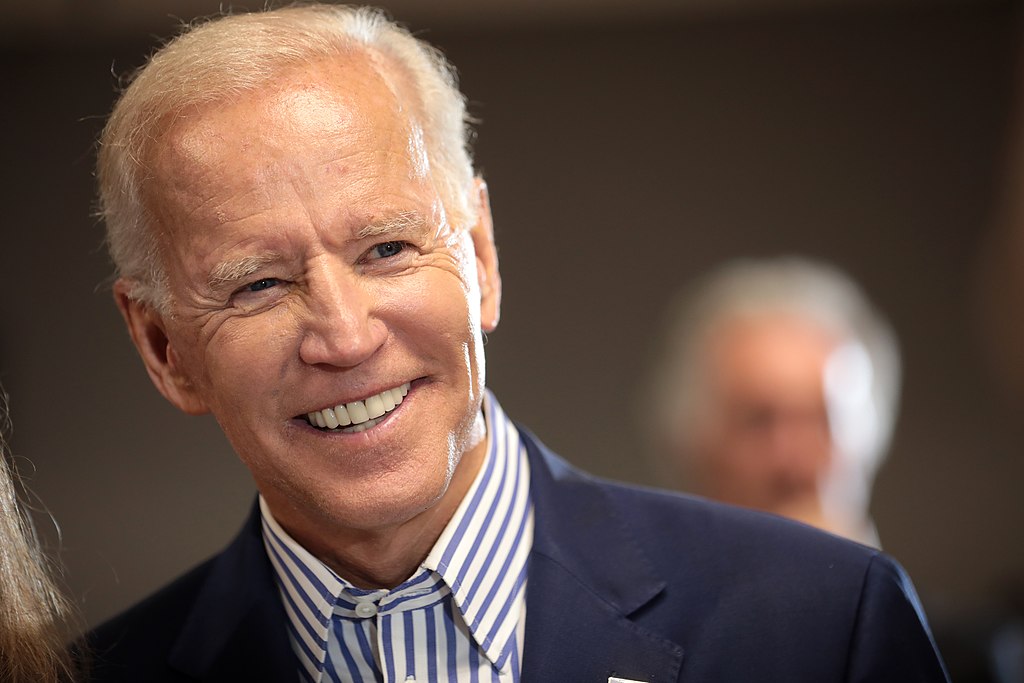

President Joe Biden has proposed raising the capital gains tax to an unprecedented 44.6% in a bold fiscal move, targeting the wealthiest Americans. This hike is part of his 2025 budget proposal to reduce income inequality.

Joe Biden's 2025 Budget Proposal Targets Wealthy with 44.6% Capital Gains Tax Increase

According to Forbes, this provision was added to Biden's budget proposal for fiscal year 2025. A footnote in the General Explanations of the Administration's Fiscal Year 2025 Revenue Proposals reads:

“A separate proposal would first raise the top ordinary rate to 39.6 percent … An additional proposal would increase the net investment income tax rate by 1.2 percentage points above $400,000 … Together, the proposals would increase the top marginal rate on long-term capital gains and qualified dividends to 44.6 percent.”

A key suggestion provides context for the aforementioned statement: boosting the long-term capital gains and qualifying dividends taxes for taxpayers to 37%. CoinGape reported that this is for taxpayers with more than $1 million taxable incomes. The 44.6% rate can only be implemented through a different proposal from the president's administration's major capital gains rate increase.

Similarly, this rate would only apply to those with taxable incomes of $1 million and $400,000 in investment income. Presenting such a capital gains rate plan is a sophisticated policy ploy that will most likely result in a high percentage while neglecting the critical issue of income thresholds.

The strategy appears to be seeking to level the playing field between high ordinary and investment-income people.

IRS Introduces New 1099-DA Form to Simplify Crypto Tax Reporting Amid Rising Tax Rates

As the administration pushes to raise taxes, many firms and individuals who may be affected may turn to digital assets to help them achieve economic freedom. At the very least, the laws governing crypto tax reporting have not yet been completely implemented, and they do not need a tax rate as high as Biden proposes.

A few days ago, the US Internal Revenue Service (IRS) released an early draft of a new tax form for reporting cryptocurrency transactions.

The form, 1099-DA, is intended to facilitate and simplify tax liabilities associated with cryptocurrency transactions. It tracks taxable profits and losses and includes sections that identify specific token codes, wallet addresses, and other transaction details.

Many investors are expected to find the form simple to complete, especially since several tax specialists tried to explain the proper procedure.

Photo: Gage Skidmore from Peoria, AZ, United States of America, CC BY-SA 2.0, via Wikimedia Commons

OpenAI Targets $600B Compute Spend as IPO Valuation Could Reach $1 Trillion

OpenAI Targets $600B Compute Spend as IPO Valuation Could Reach $1 Trillion  Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize

Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize  OpenAI Pentagon AI Contract Adds Safeguards Amid Anthropic Dispute

OpenAI Pentagon AI Contract Adds Safeguards Amid Anthropic Dispute  Trump Floats “Friendly Takeover” of Cuba as Rubio Reportedly Engages in Talks

Trump Floats “Friendly Takeover” of Cuba as Rubio Reportedly Engages in Talks  NYC Mayor Zohran Mamdani Meets President Trump to Tackle Housing Crisis and ICE Detentions

NYC Mayor Zohran Mamdani Meets President Trump to Tackle Housing Crisis and ICE Detentions  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  USITC to Review Impact of Revoking China’s PNTR Status, Potentially Raising Tariffs on Chinese Imports

USITC to Review Impact of Revoking China’s PNTR Status, Potentially Raising Tariffs on Chinese Imports  Denver Mayor Orders Police to Protect Protesters, Restricts ICE Access to City Property

Denver Mayor Orders Police to Protect Protesters, Restricts ICE Access to City Property  More U.S. Investors Join Arbitration Against South Korea Over Coupang Dispute

More U.S. Investors Join Arbitration Against South Korea Over Coupang Dispute  Argentina Senate Approves Bill to Lower Age of Criminal Responsibility to 14

Argentina Senate Approves Bill to Lower Age of Criminal Responsibility to 14  Santos Wins Court Case Over Net Zero and Sustainability Claims

Santos Wins Court Case Over Net Zero and Sustainability Claims  U.S.-Iran Nuclear Talks Show Progress but No Breakthrough Amid Rising Military Tensions

U.S.-Iran Nuclear Talks Show Progress but No Breakthrough Amid Rising Military Tensions  Amazon’s $50B OpenAI Investment Tied to AGI Milestone and IPO Plans

Amazon’s $50B OpenAI Investment Tied to AGI Milestone and IPO Plans