Kava Network-

The Kava Network is the first Layer-1 blockchain to combine the speed and scalability of the Cosmos SDK with the developer support of Ethereum.

It is a DeFi platform that accepts crypto assets as collateral like BTC, XRP, and ATOM.

Users can instruct the platform to issue loans to themselves (no counter party or credit score needed). The loans are issued to the user in a USD-pegged stablecoin called USDX.

Co-chain Architecture-

The most important feature of the Kava Network is its co-chain architecture, enabling developers to build and deploy their projects using either the EVM or Cosmos SDK execution environments with seamless interoperability between the two.

The Ethereum Co-Chain

An EVM-compatible execution environment that empowers Solidity developers and their dApps to benefit from the scalability and security of the Kava Network.

The Cosmos Co-Chain

The Cosmos co-chain is a highly scalable and secure Cosmos SDK blockchain that connects Kava to the 35+ chains and $60B+ of the Cosmos ecosystem via the IBC protocol.

The Kava network is built using Cosmos-SDK. The Cosmos SDK is a generalized framework that simplifies the process of building secure blockchain applications on top of Tendermint BFT.

Kava Network relies on a Byzantine Fault Tolerant consensus engine designed to support Proof-of-Stake systems.

Kava EVM-

Kava EVM bridges Ethereum's established smart contract functionality with the innovative, scalable, and interoperable aspects of the Cosmos SDK.

Transaction per second 10000

Block finality time- 1-3 seconds

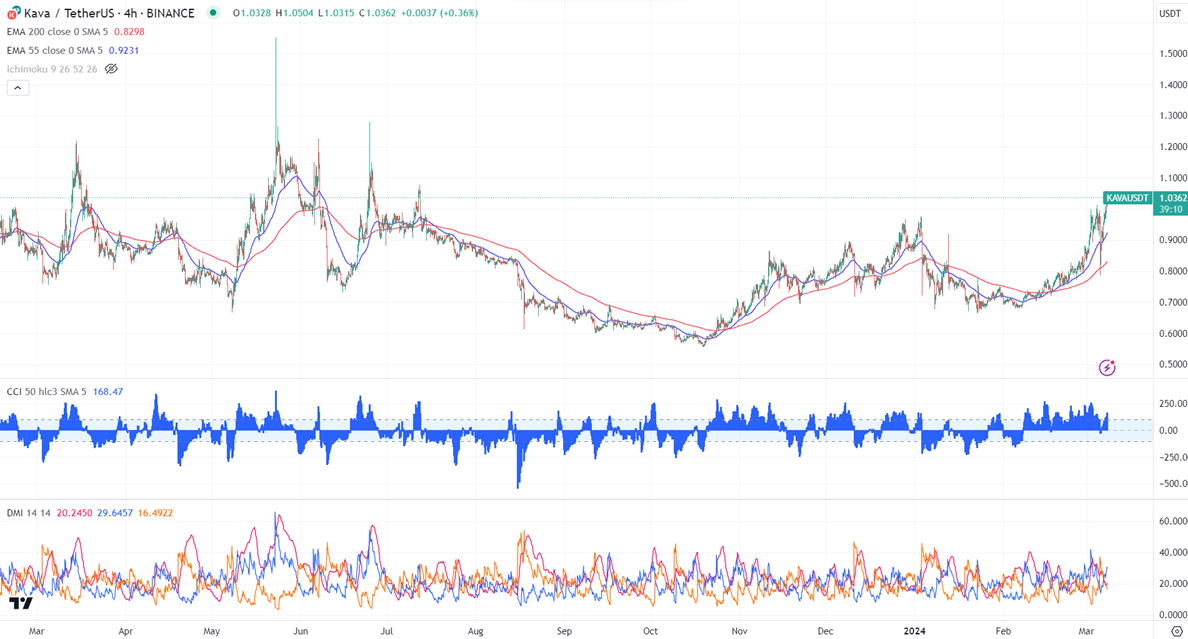

KAVAUSD surged more than 35% in the past two days. It holds above the short-term (21 and 55 EMA) and above the long-term moving average. It hit a high of $1.0577 and is currently trading around $1.0374.

The bullish invalidation can happen if the pair closes below $0.65. On the lower side, the near-term support is $0.78. Any break below targets $0.65/$0.50. Any breach below $0.50 targets $0.30.

The pair's near-term resistance is around $1.0600. Any breach above confirms minor bullishness. A jump to $1.28/$1.55 is possible. A surge past $2 will take it to $3.

.

It is good to buy on dips around $1 with SL around $0.75 for TP of $1.55/$2.

·

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close