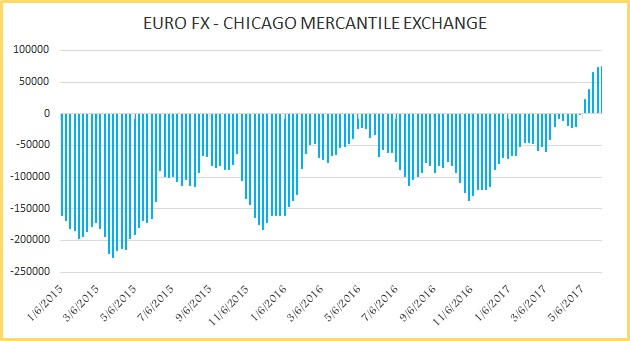

CFTC commitment of traders report was released on Friday (9th June) and cover positions up to Tuesday (6th June). COT report is not a complete presenter of entire market positions since the future market is relatively smaller compared to Spot FX market. Nevertheless, it presents crucial picture on how key participants are looking at future moves.

Key highlights:

Market participants are net short in all currencies against the dollar except the euro, Mexican peso, and the Australian dollar.

Shorts decreased:

- The short positions in the New Zealand dollar declined by 3,754 contracts to -1.8K contracts.

- Short positions in Swiss franc got declined by 1,957 contracts to -16.5K contracts.

- Short positions in the Canadian dollar declined by 3,686 contracts last week that pushed the net position to -94.5K contracts.

Shorts increased:

- The short positions in the British Pound increased for the second consecutive week and by 7,065 contracts that pushed the net position to -36.7K contracts.

- The short position in the Japanese yen increased by 2,752 contracts that pushed the net position to -55K contracts.

Long positions increased:

- Mexican peso registered the biggest increase in the long positions among peers last week as long positions got increased by 9,819 contracts to +84.8K contracts.

- The long positions in the euro increased by 1,104 contracts last week that pushed the net position to +74K contracts. Long positions increased for a fifth consecutive week.

Position shifted from long to short:

- The short positions in Aussie increased in such a fashion by 3,181 contracts that the net position shifted from long to short. The current position stands at -114 contracts.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed