Chinese imports account for the largest share in the euro area, i.e. 12.5% of total non-euro area imports in value terms, equivalent to 2.2% of euro area GDP (2014).

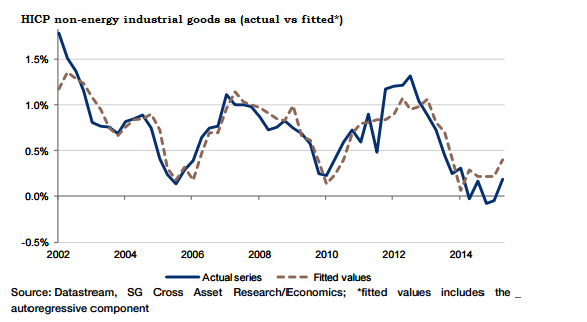

There exists a positive relationship between China's domestic producer prices (consumer goods) and euro area non-energy industrial goods prices. In the long run it is seen that the non-energy industrial goods (at level) depend considerably on the unit labour costs and capacity utilisation rate.

While in the short run, China PPI (consumer goods) at lag 1, euro area PPI ex construction and energy at lag 3 and unit labour costs affect the dependent variable.

The small coefficient of the established relationship suggests a minimal or contained impact on the prices of non-energy industrial goods in the euro area, a 10% change in China's PPI (consumer goods) leads to a 7bp change in HICP nonenergy industrial goods with a lag of one quarter.

"This suggests that price pressure in nonenergy goods is driven more by domestic factors such as unit labour cost, unemployment, and capacity utilisation rate rather than external factors, in this case, China", says Societe Generale.

Limited impact of Chinese disinflationary forces on Euro area

Wednesday, September 23, 2015 3:54 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX