United Kingdom's credit and monsy supply data is scheduled to release today.

"The Money and Credit release of the country should show broad money growth (M4 exIOFCs) proceeding at a healthy pace of close to 4% 3mth p.a, more than enough to support a reasonable pace of activity growth. Net consumer credit growth should rise by another £1.2bn, consistent with a firm trend in retail sales, but mortgage growth is likely to remain far softer", says Societe Generale in a report to its client.

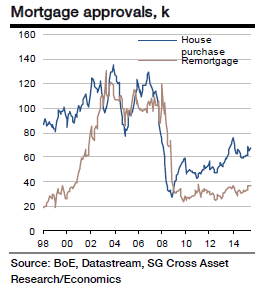

The BBA approvals data showed an extremely modest increase and we expect that to be corroborated in the BoE data with a rise of only 0.6k from 68.8k to 69.4k.

Modest increase in U.K. September mortgage approvals likely

Tuesday, September 29, 2015 7:29 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX